An Initial Public Offering (IPO) in Nepal is the process by which a private company offers its shares to the public for the first time. This transition from a private to a public company allows Nepali businesses to raise capital from a broad base of investors. The Securities Board of Nepal (SEBON) oversees the IPO process, ensuring compliance with regulatory requirements. IPOs provide an opportunity for Nepali companies to expand their operations, improve their financial standing, and enhance their public profile. The Nepal Stock Exchange (NEPSE) serves as the primary platform for trading these newly issued shares.

What are the requirements for an IPO in Nepal?

To initiate an IPO in Nepal, companies must meet specific criteria set by SEBON:

- Minimum Paid-up Capital: The company must have a minimum paid-up capital as specified by SEBON for the respective industry sector.

- Operational History: A track record of profitable operations for at least three consecutive years.

- Net Worth: The company’s net worth should be positive and at least equal to its paid-up capital.

- Debt-Equity Ratio: The ratio should not exceed 4:1 at the time of application.

- Board Composition: The company must have a diverse board of directors, including independent members.

- Corporate Governance: Adherence to SEBON’s corporate governance guidelines is mandatory.

- Financial Statements: Audited financial statements for the past three years are required.

- Credit Rating: A credit rating from a SEBON-approved agency is necessary.

- Due Diligence: A comprehensive due diligence report from a merchant banker is required.

- Prospectus: A detailed prospectus must be prepared and approved by SEBON.

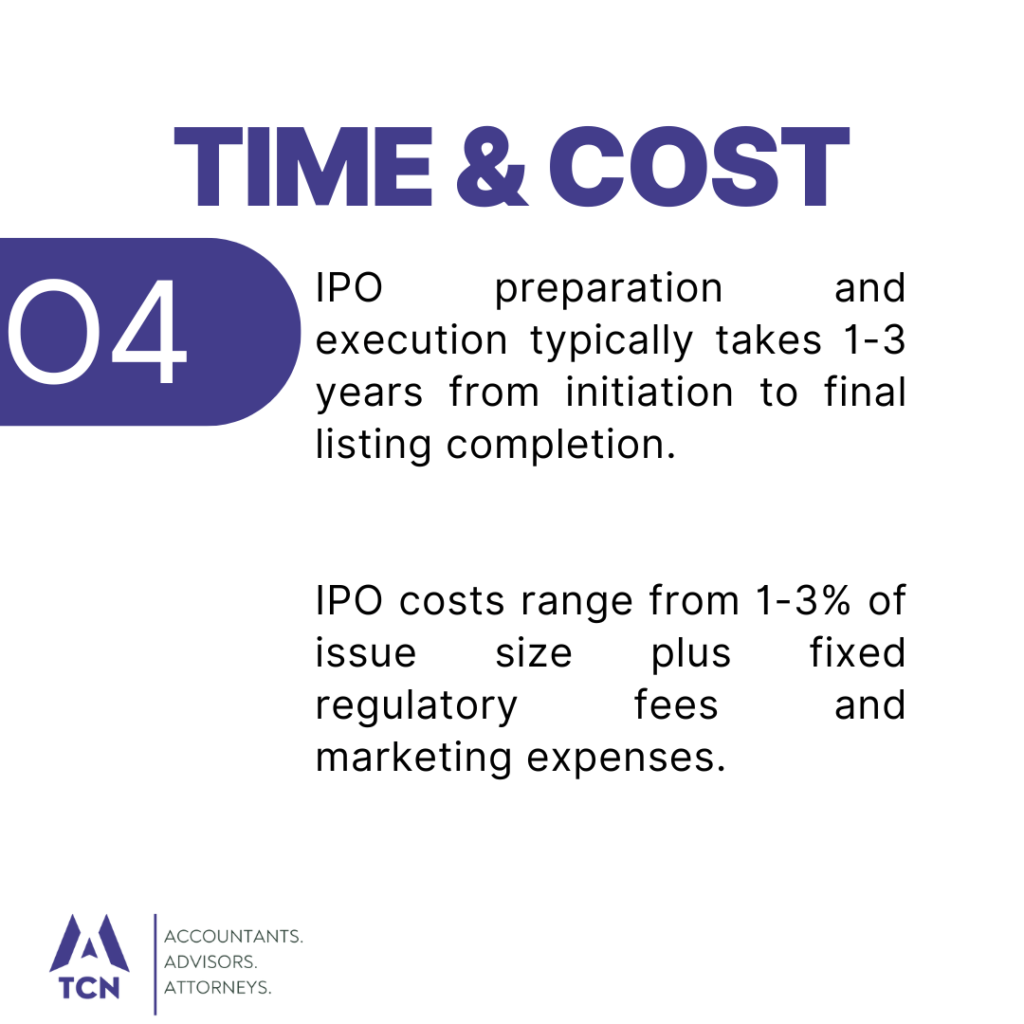

How long does the IPO process take in Nepal?

The IPO process in Nepal typically takes 6 to 12 months from initiation to listing. This timeline can vary based on factors such as company readiness, market conditions, and regulatory approvals. The process involves several stages:

- Pre-IPO Preparation: 2-3 months

- SEBON Application and Approval: 2-3 months

- Marketing and Book Building: 1-2 months

- Subscription Period: 3-5 days

- Share Allotment: 1-2 weeks

- Listing on NEPSE: 2-4 weeks

Companies should plan well in advance and work closely with their advisors to ensure a smooth and timely IPO process.

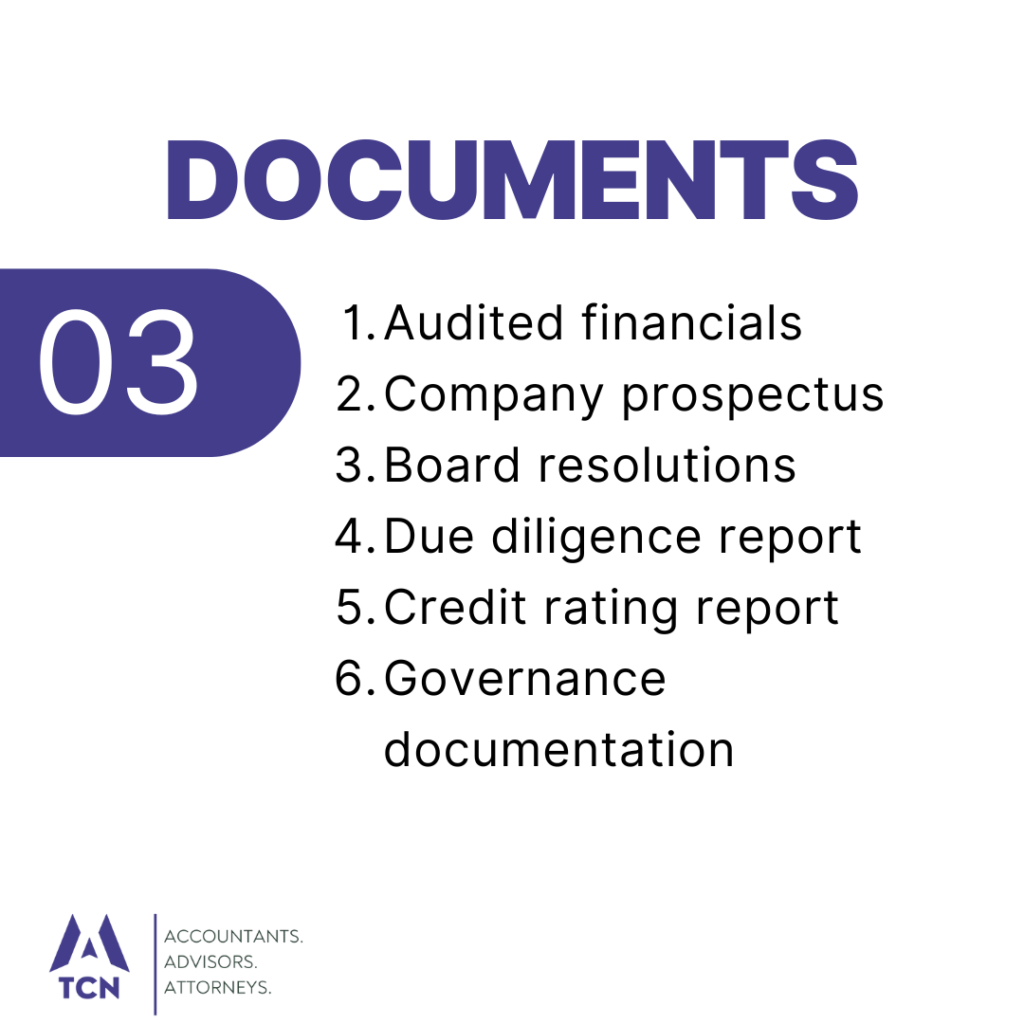

What documents are needed for an IPO in Nepal?

The following documents are essential for an IPO in Nepal:

- Audited financial statements for the past three years

- Memorandum and Articles of Association

- Board resolution approving the IPO

- Due diligence report from a merchant banker

- Credit rating report

- Detailed prospectus

- Legal opinion on the company’s affairs

- Underwriting agreements

- NOC from relevant regulatory bodies (if applicable)

- Tax clearance certificates

- Company registration certificate

- PAN registration certificate

- Shareholding structure

- Directors’ and promoters’ details

- Business plan and financial projections

- Corporate governance report

- Environmental compliance certificate (if applicable)

Who regulates IPOs in Nepal?

The Securities Board of Nepal (SEBON) is the primary regulatory body overseeing IPOs in Nepal. SEBON’s responsibilities include:

- Formulating and enforcing IPO regulations

- Reviewing and approving IPO applications

- Ensuring investor protection

- Monitoring the IPO process

- Enforcing compliance with securities laws

- Approving prospectuses

- Granting licenses to market intermediaries

- Investigating and penalizing violations

Other regulatory bodies that may be involved in the IPO process include:

- Nepal Rastra Bank (NRB) for banking and financial institutions

- Insurance Board for insurance companies

- Company Registrar’s Office for company registration matters

- Nepal Stock Exchange (NEPSE) for listing requirements

What are the costs associated with an IPO in Nepal?

The costs of an IPO in Nepal can be substantial and typically include:

- Underwriting Fees: 1-3% of the issue size

- Legal Fees: NPR 500,000 – 2,000,000

- Auditor Fees: NPR 300,000 – 1,000,000

- Merchant Banker Fees: 0.5-1% of the issue size

- Marketing and Advertising: NPR 1,000,000 – 5,000,000

- Printing and Distribution: NPR 500,000 – 2,000,000

- SEBON Filing Fees: 0.15% of the issue size

- NEPSE Listing Fees: Based on the company’s paid-up capital

- Share Registrar Fees: NPR 200,000 – 500,000

- Credit Rating Fees: NPR 300,000 – 1,000,000

Companies should budget for these expenses and factor them into their IPO planning.

How to determine the IPO price in Nepal?

Determining the IPO price in Nepal involves several factors:

- Book Building: For qualified institutional buyers, a price discovery mechanism is used.

- Fixed Price: For retail investors, a fixed price is set based on various factors.

- Net Asset Value: The company’s NAV per share is considered.

- Price-Earnings Ratio: Comparison with industry peers’ P/E ratios.

- Discounted Cash Flow: Future cash flows are discounted to present value.

- Market Conditions: Overall market sentiment and sector performance are factored in.

- Growth Prospects: The company’s future growth potential is evaluated.

- Financial Performance: Historical and projected financial results are analyzed.

- Regulatory Guidelines: SEBON’s pricing guidelines must be adhered to.

- Underwriter Recommendations: Experienced underwriters provide pricing insights.

The final IPO price should balance the company’s valuation with investor attractiveness.

Why do companies in Nepal choose to go public?

Companies in Nepal opt for IPOs for several reasons:

- Capital Raising: IPOs provide access to substantial funds for expansion, debt repayment, or research and development.

- Enhanced Credibility: Public companies often enjoy increased trust from customers, suppliers, and partners.

- Liquidity for Shareholders: Existing shareholders can easily trade their shares on the NEPSE.

- Market Valuation: IPOs establish a clear market value for the company.

- Publicity: The IPO process generates significant media attention and public awareness.

- Employee Retention: Public companies can offer stock options, attracting and retaining talent.

- Mergers and Acquisitions: Publicly traded shares can be used as currency in M&A transactions.

- Regulatory Compliance: Public companies adhere to stricter governance standards, potentially improving operations.

What is the role of underwriters in Nepali IPOs?

Underwriters play a crucial role in Nepali IPOs:

- Issue Management: They manage the entire IPO process.

- Due Diligence: Conduct thorough investigations of the company’s affairs.

- Pricing: Assist in determining an appropriate IPO price.

- Risk Mitigation: Underwrite the issue, guaranteeing share subscription.

- Marketing: Promote the IPO to potential investors.

- Regulatory Compliance: Ensure adherence to SEBON regulations.

- Documentation: Prepare and file necessary documents with SEBON.

- Investor Relations: Act as a liaison between the company and investors.

- Post-IPO Support: Provide market-making services after listing.

- Advisory Services: Offer strategic advice throughout the IPO process.

Underwriters are typically merchant banks or investment firms licensed by SEBON.

How to market an IPO to Nepali investors?

Marketing an IPO to Nepali investors involves several strategies:

- Media Campaigns: Utilize print, television, and online media for widespread reach.

- Investor Presentations: Conduct roadshows in major cities to engage potential investors.

- Digital Marketing: Leverage social media and online platforms for targeted outreach.

- Broker Networks: Collaborate with stockbrokers to promote the IPO to their clients.

- Press Conferences: Hold press events to generate media coverage and public interest.

- Prospectus Distribution: Ensure wide availability of the prospectus through various channels.

- Educational Seminars: Organize investor education programs to explain the IPO process.

- Celebrity Endorsements: Engage well-known personalities to create buzz (if appropriate).

- Mobile Apps: Develop user-friendly apps for easy access to IPO information and application.

- Community Outreach: Engage with local communities to build trust and awareness.

Effective marketing should focus on transparency, investor education, and highlighting the company’s strengths and growth potential.

What are the legal considerations for IPOs in Nepal?

Legal considerations for IPOs in Nepal include:

- Companies Act Compliance: Adherence to the Companies Act, 2063 (2006).

- Securities Act Compliance: Compliance with the Securities Act, 2063 (2007).

- SEBON Regulations: Adherence to various SEBON guidelines and directives.

- Disclosure Requirements: Full and accurate disclosure of material information.

- Corporate Governance: Implementation of robust corporate governance practices.

- Insider Trading: Establishment of policies to prevent insider trading.

- Intellectual Property: Protection of trademarks, patents, and other IP rights.

- Employment Laws: Compliance with labor laws and regulations.

- Environmental Regulations: Adherence to environmental standards (if applicable).

- Tax Implications: Understanding and planning for tax consequences of going public.

Companies should engage experienced legal counsel to navigate these complex legal requirements.

How to prepare financial statements for an IPO?

Preparing financial statements for an IPO in Nepal involves:

- NFRS Compliance: Ensure adherence to Nepal Financial Reporting Standards.

- Audit Quality: Engage reputable auditors for a thorough audit.

- Historical Data: Provide audited statements for the past three years.

- Interim Financials: Include recent unaudited financial information.

- Projections: Prepare realistic financial projections for future years.

- Segment Reporting: Break down financial data by business segments.

- Related Party Transactions: Disclose all related party dealings.

- Accounting Policies: Clearly state and explain significant accounting policies.

- Risk Factors: Identify and quantify financial risks.

- Management Discussion: Include a comprehensive management discussion and analysis.

Transparency and accuracy are paramount in financial statement preparation for IPOs.

What happens after the IPO is completed in Nepal?

Post-IPO activities in Nepal include:

- Share Allotment: Allocate shares to successful applicants.

- Refunds: Process refunds for unsuccessful or partially successful applicants.

- Listing: List the company’s shares on the Nepal Stock Exchange.

- Trading Commencement: Begin trading of shares on NEPSE.

- Regulatory Reporting: Submit regular reports to SEBON and NEPSE.

- Investor Relations: Establish an investor relations department.

- Corporate Governance: Implement public company governance practices.

- Financial Reporting: Adhere to stricter financial reporting requirements.

- Market Making: Engage in market-making activities to ensure liquidity.

- Analyst Coverage: Facilitate analyst coverage of the company.

Companies must adapt to the increased scrutiny and responsibilities of being a public entity.

Contract Drafting Process in Nepal

Corporate Restructuring Process in Nepal

Bank Reconciliation in Nepal

How to evaluate the success of an IPO in Nepal?

Evaluating IPO success in Nepal involves analyzing:

- Subscription Rate: The level of oversubscription indicates investor interest.

- Price Performance: Post-listing share price movement compared to the IPO price.

- Trading Volume: High trading volumes suggest strong investor participation.

- Market Capitalization: Increase in market cap indicates value creation.

- Investor Base: Diversity and quality of the new shareholder base.

- Media Coverage: Positive media attention can boost the company’s profile.

- Analyst Ratings: Favorable analyst reports indicate market confidence.

- Funds Raised: Achievement of capital raising objectives.

- Operational Improvements: Enhanced operations due to raised capital.

- Brand Recognition: Increased brand awareness and reputation.

A successful IPO should meet the company’s financial goals while creating value for new shareholders.

What are the risks associated with IPOs in Nepal?

Risks associated with IPOs in Nepal include:

- Market Volatility: Share prices may fluctuate due to market conditions.

- Regulatory Compliance: Failure to meet ongoing regulatory requirements.

- Underpricing: Leaving money on the table if shares are underpriced.

- Overpricing: Poor aftermarket performance if shares are overpriced.

- Operational Pressure: Increased scrutiny may affect operational decisions.

- Disclosure Risks: Legal liabilities from inadequate or inaccurate disclosures.

- Competitive Exposure: Detailed public disclosures may benefit competitors.

- Management Distraction: The IPO process can divert focus from core operations.

- Investor Expectations: Pressure to meet short-term market expectations.

- Dilution: Existing shareholders may experience ownership dilution.

Companies should carefully weigh these risks against the benefits of going public.

Additional FAQs:

What is the minimum company size for an IPO?

The minimum company size for an IPO in Nepal varies by sector. Generally, companies must have a minimum paid-up capital as specified by SEBON. For instance, commercial banks require a minimum paid-up capital of NPR 8 billion, while manufacturing companies may need NPR 50 million. SEBON periodically reviews and updates these requirements.

How does an IPO affect company management?

An IPO significantly impacts company management:

- Increased Accountability: Management becomes answerable to a broader shareholder base.

- Transparency Requirements: Regular public disclosures become mandatory.

- Strategic Focus: Long-term strategy may shift to balance growth with quarterly results.

- Board Composition: Independent directors are required on the board.

- Compensation Scrutiny: Executive compensation becomes subject to public scrutiny.

Management must adapt to these changes while maintaining focus on company growth.

What is the lock-up period for IPOs in Nepal?

In Nepal, the lock-up period for promoter shares is typically one year from the date of allotment. During this period, promoters cannot sell their shares. This restriction aims to align promoter interests with those of public shareholders and maintain market stability post-IPO.

How do economic conditions impact IPO timing?

Economic conditions significantly influence IPO timing:

- Market Sentiment: Bullish markets often lead to more IPOs.

- Interest Rates: Low rates can make equities more attractive to investors.

- Sector Performance: Strong sector performance can boost IPO prospects.

- Economic Growth: Robust GDP growth often correlates with successful IPOs.

- Investor Liquidity: High liquidity in the market can support IPO subscriptions.

Companies should time their IPOs to coincide with favorable economic conditions for optimal results.

What are the alternatives to an IPO in Nepal?

Alternatives to IPOs in Nepal include:

- Private Equity: Raising capital from private equity firms.

- Venture Capital: Seeking investment from venture capital funds.

- Bank Loans: Obtaining debt financing from banks.

- Rights Issues: Offering new shares to existing shareholders.

- Private Placements: Selling shares to a select group of investors.

- Mergers and Acquisitions: Combining with or being acquired by another company.

Each alternative has its own advantages and considerations compared to an IPO.

How do foreign investors participate in Nepali IPOs?

Foreign investors can participate in Nepali IPOs through:

- Foreign Investment and Technology Transfer Act (FITTA) approval.

- Opening a demat account with a Nepali custodian bank.

- Obtaining a Capital Gains Tax Clearance Certificate.

- Applying for shares through a licensed broker.

- Complying with foreign investment limits set by regulators.

Foreign participation is subject to sector-specific restrictions and requires compliance with Nepal Rastra Bank and SEBON regulations.

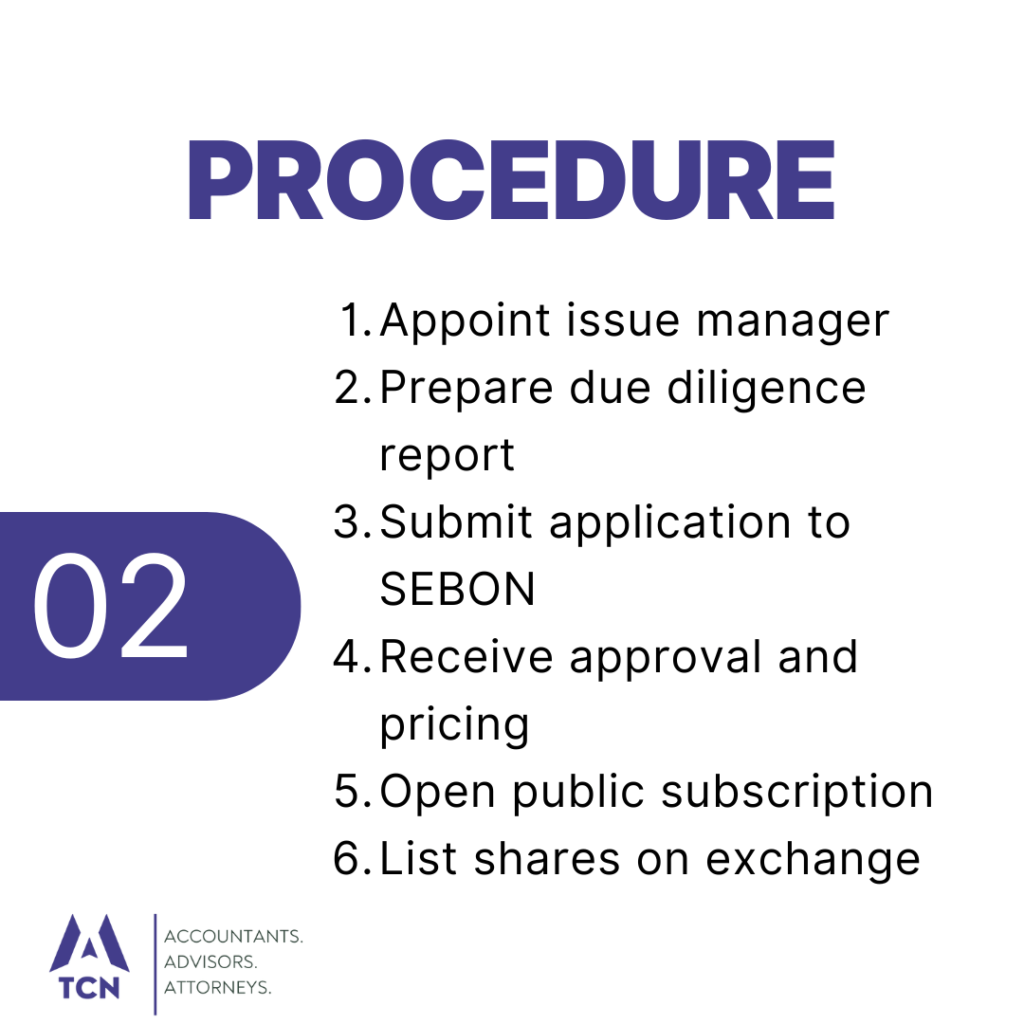

What is the process of IPO in Nepal?

1. Initial Steps: Company hires a merchant banker to assess IPO readiness.

2. Due Diligence: Financial and legal audits are conducted.

3. Filing with SEBON: Submission of IPO draft to the Securities Board of Nepal (SEBON) for approval.

4 Approval & Pricing: SEBON approves the IPO, and the price band is determined.

5. Public Offering: IPO shares are offered to the public via an open auction or fixed price.

6. Listing on Stock Exchange: Post-issue, shares are listed on the Nepal Stock Exchange (NEPSE).

7. Trading Begins: Shares are traded on the stock exchange, allowing investors to buy and sell.

What are the 7 steps to getting an IPO?

1. Appoint Merchant Banker: Engage a licensed merchant banker to guide the process.

2. Due Diligence & Audits: Perform internal audits and prepare financial statements.

3. File IPO Application with SEBON: Submit required documents to SEBON for approval.

4. Pricing & Prospectus Drafting: Define share pricing and prepare the IPO prospectus.

5. Regulatory Approval: Obtain SEBON’s approval for the IPO.

6. Public Subscription: Open the IPO for public subscription, either through a fixed price or auction method.

7. Stock Exchange Listing: After the IPO, list the shares on the Nepal Stock Exchange for trading.

What is IPO preparation?

IPO preparation involves several key steps to ensure a smooth public offering. This includes conducting a health check of the company’s financials, governance, and business model. It also involves performing audits to ensure financial statements comply with regulations. The company must draft an IPO prospectus, detailing the company’s performance, future plans, and other relevant information. The company then appoints a merchant banker to manage the IPO process. Finally, the company prepares and submits the necessary documents to SEBON for approval, ensuring compliance with the regulatory requirements.

What is executed in IPO?

In an IPO, the company issues new shares to the public or existing shareholders as part of the public offering. These shares are then listed on the Nepal Stock Exchange (NEPSE), allowing them to be traded in the open market. This process enables investors to buy shares during the public offering, and after the shares are listed, they can continue trading them on the stock exchange, providing liquidity and opportunities for growth.

What is the IPO selection process?

1. Eligibility Criteria: Companies must meet SEBON’s financial and governance standards.

2. Merchant Banker Role: A merchant banker evaluates the company’s readiness for an IPO.

3. Regulatory Approval: SEBON reviews the company’s IPO application and prospectus.

4. Public Offering Strategy: Companies decide on the offering method (auction/fixed price) and share pricing.

5. Final Approval: After compliance checks, SEBON grants approval for the IPO to proceed.

Get in Touch with Us

Our team consists of Chartered Accountants, Corporate Lawyers and Chartered Financial Analysts. Our Firm is renowned for provide expert legal, tax and financial services. Contact us for Quick Legal and Tax Consultation.

📧 Email: info@taxconsultantnepal.com

📞 Phone: +977 9840993599

📍 Location: Sinamangal Marga, Old Baneshwor, Kathmandu, Nepal

You can contact us via email, contact form, or phone call. We are also available on WhatsApp, Viber, Telegram, and WeChat for your convenience. Feel free to drop your queries, and our professionals will get back to you promptly.