Understanding Company Registration in Nepal

Company registration in Nepal is the legal process of establishing a business entity recognized by the government. It involves officially registering a company with the Office of Company Registrar (OCR) under the Ministry of Industry, Commerce, and Supplies. This process is governed by the Companies Act, 2063 (2006) and its subsequent amendments. Registering a company provides it with a separate legal identity, limited liability protection for shareholders, and the ability to conduct business operations legally in Nepal.

What is company registration?

Company registration is the formal process of incorporating a business entity in Nepal. It involves submitting required documents, paying necessary fees, and obtaining approval from the Office of Company Registrar. This process gives the company a legal existence, allowing it to operate as a separate entity from its owners. Registration is mandatory for all types of companies, including private limited companies, public limited companies, and non-profit organizations. The Companies Act, 2063 (2006) outlines the legal framework for company registration in Nepal.

How to register a company in Nepal?

To register a company in Nepal, follow these steps:

- Choose a unique company name

- Prepare required documents

- Submit application to the Office of Company Registrar

- Pay registration fees

- Obtain approval and registration certificate

- Register for PAN and VAT (if applicable)

- Open a company bank account

- Obtain necessary licenses and permits

The process may vary slightly depending on the type of company being registered. It’s advisable to consult with a professional service like Tax Consultant Nepal for guidance through the registration process.

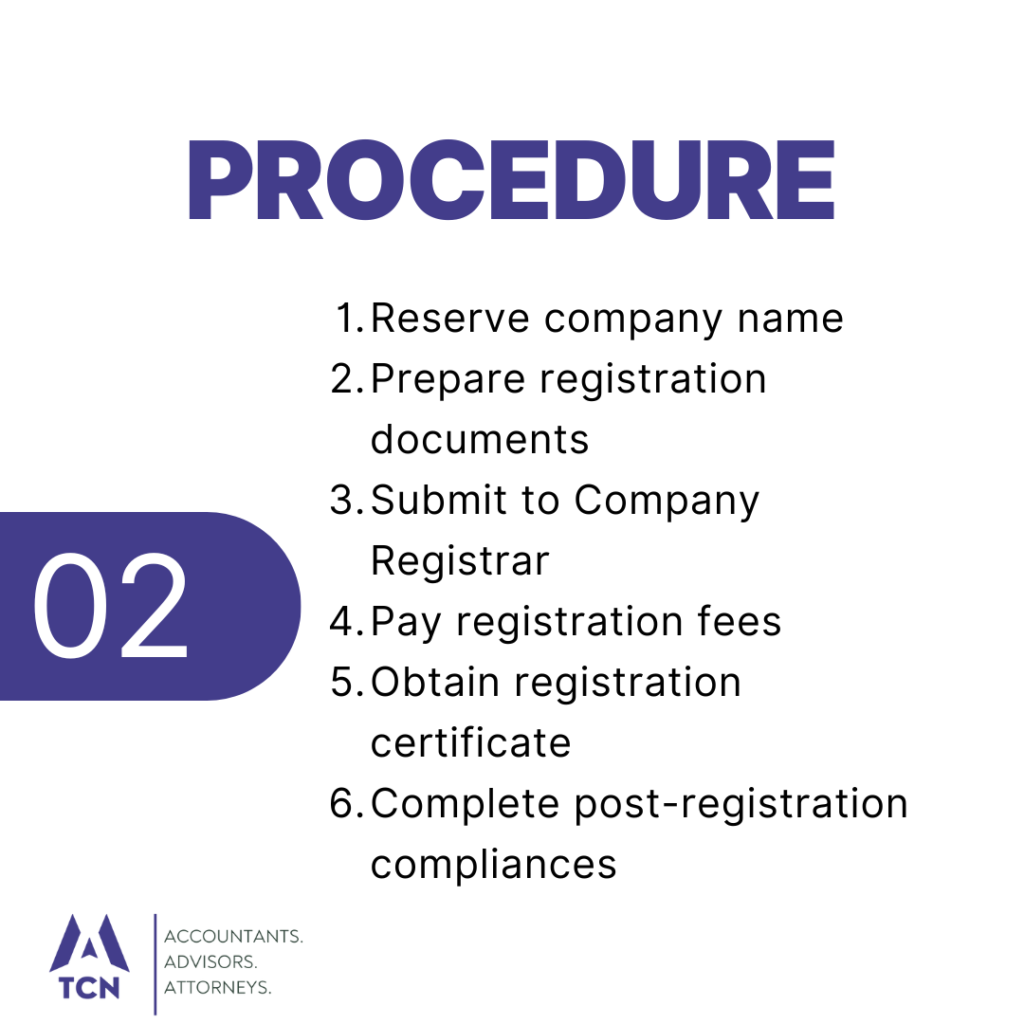

What is the process for company registration?

The company registration process in Nepal involves several steps:

- Name reservation: Submit a company name for approval

- Document preparation: Gather all required documents

- Application submission: Submit the application to the OCR

- Fee payment: Pay the required registration fees

- Document verification: OCR reviews submitted documents

- Registration approval: OCR issues registration certificate

- Post-registration steps: Obtain PAN, VAT registration, and other necessary permits

The Companies Act, 2063 (2006) and the Company Registration Rules, 2064 (2007) provide the legal framework for this process. Tax Consultant Nepal can assist in navigating these steps efficiently.

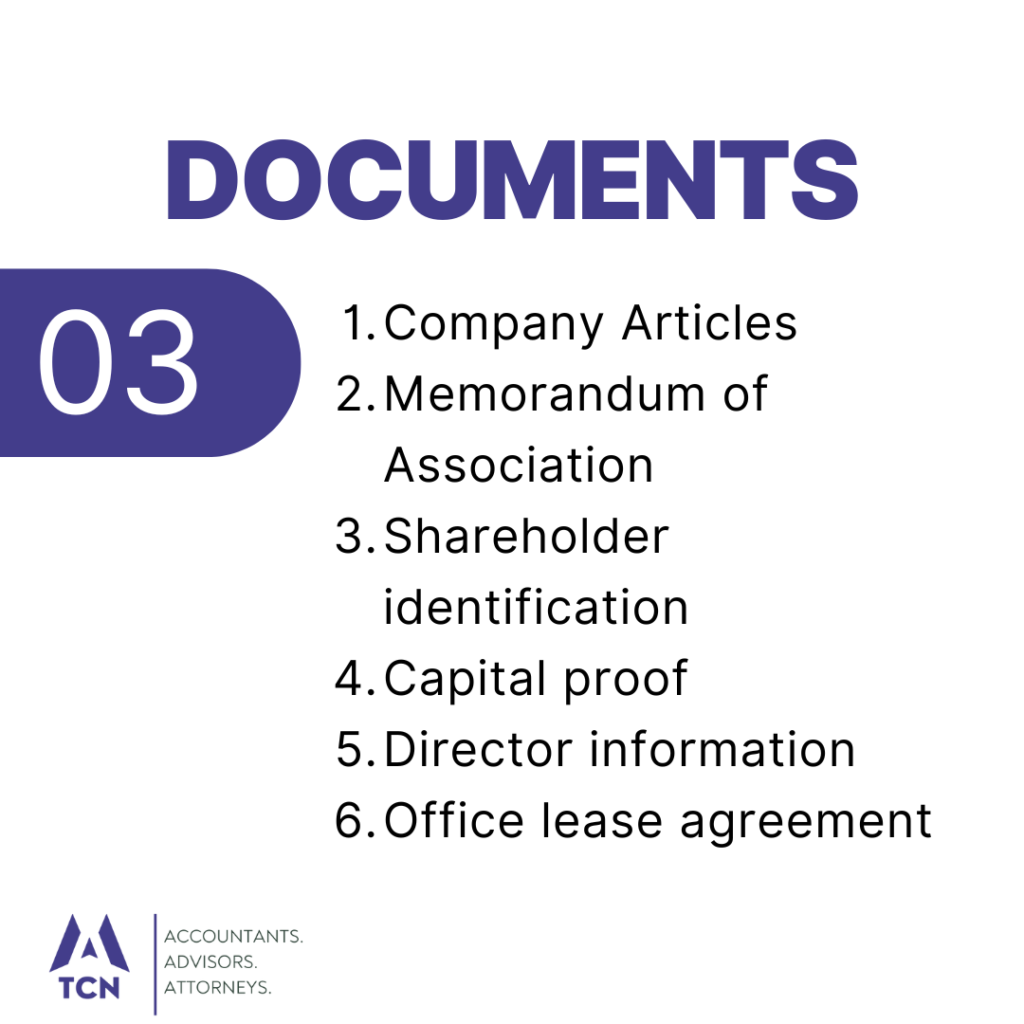

What documents are required for registration?

The following documents are typically required for company registration in Nepal:

- Memorandum of Association

- Articles of Association

- Company name reservation letter

- Citizenship certificates of promoters/directors

- Passport-sized photographs of promoters/directors

- No Objection Letters from relevant authorities (if applicable)

- Power of Attorney (if applicable)

- Bank voucher for registration fee payment

- Lease agreement for company office

- Additional documents for foreign investment (if applicable)

The specific requirements may vary based on the type of company and nature of business. Tax Consultant Nepal can provide detailed guidance on document preparation.

How long does company registration take?

The duration of company registration in Nepal can vary depending on several factors. Typically, the process takes between 2 to 4 weeks from the initial application submission to receiving the registration certificate. However, this timeline can be affected by:

- Completeness of submitted documents

- Workload of the Office of Company Registrar

- Complexity of the company structure

- Any additional approvals required

To expedite the process, it’s crucial to ensure all documents are correctly prepared and submitted. Tax Consultant Nepal can help streamline the registration process, potentially reducing the overall time required.

What is the cost of company registration?

The cost of company registration in Nepal includes various fees and charges:

- Registration fee: Varies based on authorized capital

- Name reservation fee: NPR 100

- Document processing fee: NPR 1,000

- PAN registration fee: NPR 500

- VAT registration fee (if applicable): NPR 1,000

- Professional service fees (if using a consultant)

Additional costs may include notary fees, stamp duties, and fees for obtaining specific licenses or permits. The Companies Act, 2063 (2006) and related regulations outline the official fee structure. Tax Consultant Nepal can provide a detailed cost breakdown based on your specific company requirements.

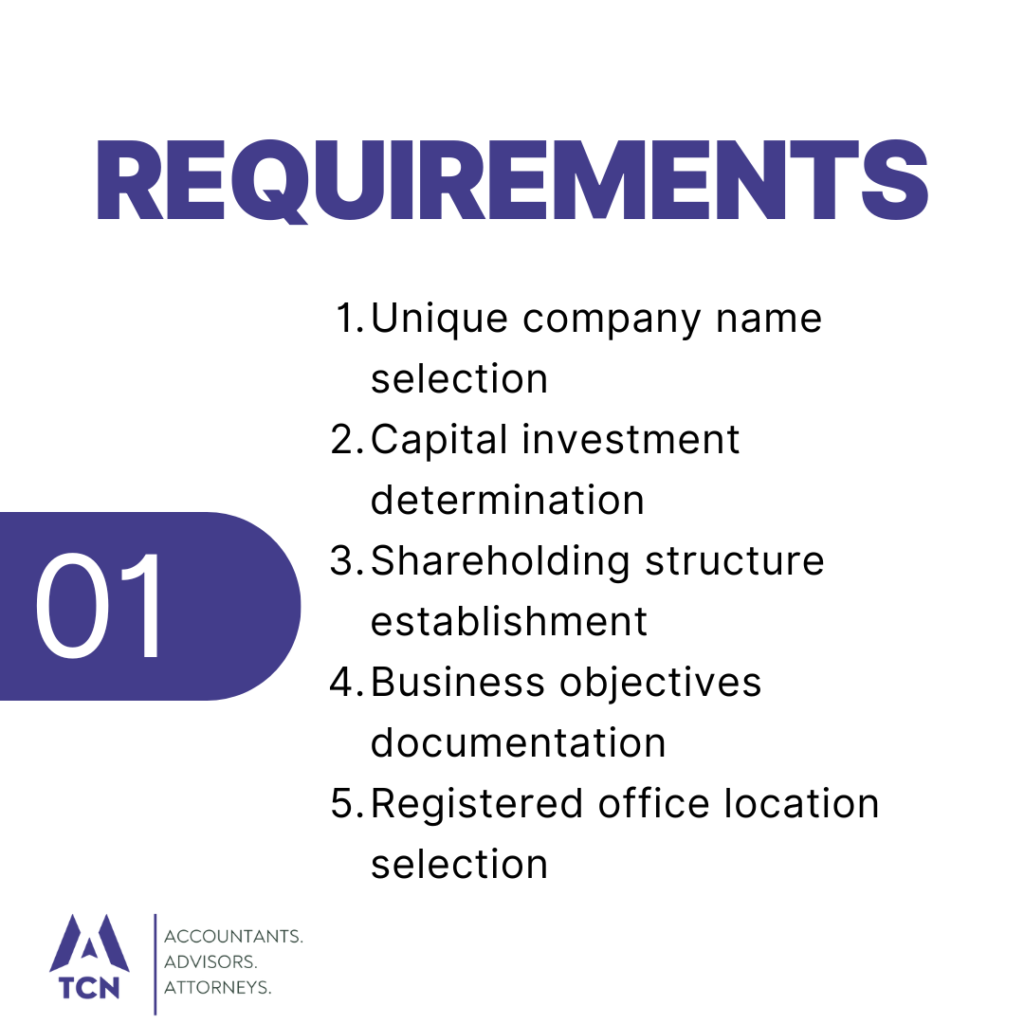

What are the requirements for company registration?

The key requirements for company registration in Nepal include:

- Unique company name

- Minimum number of promoters/shareholders

- Minimum paid-up capital

- Registered office address in Nepal

- Memorandum and Articles of Association

- Citizenship or passport copies of promoters/directors

- Compliance with sector-specific regulations (if applicable)

- Foreign Investment approval (for foreign-owned companies)

These requirements are stipulated in the Companies Act, 2063 (2006) and may vary depending on the type of company being registered. Tax Consultant Nepal can help ensure all requirements are met for a smooth registration process.

Where to register a company in Nepal?

Companies in Nepal are registered with the Office of Company Registrar (OCR), which falls under the Ministry of Industry, Commerce, and Supplies. The main office is located in Kathmandu, but there are also branch offices in other major cities. The registration process can be initiated online through the OCR’s website, but physical document submission is still required. For convenience and efficiency, many businesses choose to use professional services like Tax Consultant Nepal to handle the registration process on their behalf.

What laws govern company registration?

Company registration in Nepal is primarily governed by the following laws and regulations:

- Companies Act, 2063 (2006)

- Company Registration Rules, 2064 (2007)

- Industrial Enterprises Act, 2076 (2020)

- Foreign Investment and Technology Transfer Act, 2075 (2019)

- Income Tax Act, 2058 (2002)

- Value Added Tax Act, 2052 (1996)

These laws provide the legal framework for company formation, operation, and governance in Nepal. Tax Consultant Nepal stays updated with all relevant laws and regulations to ensure compliance throughout the registration process.

Which authority registers companies in Nepal?

The Office of Company Registrar (OCR) is the primary authority responsible for registering companies in Nepal. It operates under the Ministry of Industry, Commerce, and Supplies. The OCR’s main functions include:

- Registering new companies

- Maintaining company records

- Issuing company registration certificates

- Approving company name reservations

- Overseeing company compliance with regulations

Other authorities may be involved in the registration process depending on the nature of the business, such as the Department of Industry for industrial enterprises or the Nepal Rastra Bank for financial institutions.

Can foreigners register a company in Nepal?

Yes, foreigners can register a company in Nepal, subject to certain conditions and approvals. The Foreign Investment and Technology Transfer Act, 2075 (2019) governs foreign investment in Nepal. Key points to consider:

- Minimum investment requirements apply

- Approval from the Department of Industry is necessary

- Certain sectors may have restrictions on foreign ownership

- Joint ventures with Nepali partners may be required in some cases

- Repatriation of profits is allowed as per Nepal Rastra Bank regulations

Foreign investors should consult with experts like Tax Consultant Nepal to navigate the specific requirements and restrictions for foreign-owned companies in Nepal.

How to renew company registration?

Company registration renewal in Nepal involves:

- Annual filing of financial statements

- Payment of annual fees

- Updating company information if changes occurred

- Submitting tax clearance certificates

The renewal process typically occurs annually, with deadlines based on the company’s fiscal year. Failure to renew can result in penalties or even company dissolution. Tax Consultant Nepal can assist in managing timely renewals and ensuring ongoing compliance with regulatory requirements.

Services Offered by Tax Consultant Nepal

1. Company Registration Assistance

Tax Consultant Nepal provides comprehensive support for company registration in Nepal. Our services include name reservation, document preparation, application submission, and liaison with the Office of Company Registrar. We guide clients through each step of the process, ensuring all legal requirements are met and minimizing potential delays. Our expertise covers various company types, including private limited, public limited, and foreign investment companies.

2. Document Preparation

We assist in preparing all necessary documents for company registration, including Memorandum of Association, Articles of Association, and other required forms. Our team ensures that all documents comply with the latest legal requirements and are tailored to your specific business needs. We also help in obtaining necessary certifications and attestations, streamlining the document preparation process.

3. Legal Compliance Advisory

Our legal compliance advisory service helps businesses navigate the complex regulatory landscape in Nepal. We provide guidance on compliance with the Companies Act, Foreign Investment and Technology Transfer Act, and other relevant laws. This service includes ongoing support to ensure your company remains compliant with changing regulations and reporting requirements.

4. Tax Registration and Compliance

We assist in obtaining Permanent Account Number (PAN) and Value Added Tax (VAT) registration for your company. Our services extend to ongoing tax compliance, including preparation and filing of tax returns, handling tax audits, and providing strategic tax planning advice to optimize your company’s tax position in compliance with Nepal’s tax laws.

5. Business License Acquisition

Tax Consultant Nepal helps in obtaining various business licenses and permits required for your company’s operations. We identify the specific licenses needed based on your business activities and assist in the application process. This includes industry-specific licenses, environmental clearances, and other regulatory approvals necessary for legal operation in Nepal.

6. Foreign Investment Facilitation

For foreign investors, we provide specialized services to facilitate investment in Nepal. This includes assistance with foreign investment approval processes, guidance on sector-specific regulations, and support in establishing joint ventures or wholly-owned subsidiaries. We also advise on repatriation of profits and compliance with foreign exchange regulations.

7. Annual Compliance Management

Our annual compliance management service ensures your company meets all ongoing regulatory requirements. This includes annual return filings, renewal of company registration, updating company records, and ensuring compliance with corporate governance standards. We help you avoid penalties and maintain good standing with regulatory authorities.

8. Corporate Restructuring

We provide expert advice and assistance in corporate restructuring activities such as mergers, acquisitions, and company dissolutions. Our services include due diligence, preparation of necessary documents, and liaison with relevant authorities to ensure smooth execution of restructuring processes in compliance with Nepal’s legal framework.

9. Intellectual Property Registration

Tax Consultant Nepal assists in protecting your company’s intellectual property rights in Nepal. We help with trademark registration, patent applications, and copyright registrations. Our services include conducting preliminary searches, preparing and filing applications, and following up with the Department of Industry to secure your intellectual property rights.

10. Business Advisory Services

Our comprehensive business advisory services cover various aspects of company operations in Nepal. We provide guidance on market entry strategies, business expansion, investment opportunities, and regulatory compliance. Our team offers insights into local business practices, helps in developing business plans, and provides ongoing support to navigate the Nepali business environment effectively.