Introduction to Tax Slab Nepal 2025

The Tax Slab Nepal 2025 has been structured to provide clarity and fairness in Nepal’s evolving tax system. As Nepal continues its economic development journey, understanding these tax structures becomes essential for both individuals and businesses. The Inland Revenue Department of Nepal has introduced several modifications to the existing tax framework, aiming to streamline revenue collection while ensuring equitable distribution of tax burdens. This comprehensive guide will walk you through all aspects of the Nepal tax system for 2025, helping you navigate your financial obligations with confidence.

What is Tax Slab Nepal 2025?

The Tax Slab Nepal 2025 refers to the structured system of tax rates applied to different income levels and categories within Nepal. These slabs are designed to implement a progressive taxation system where higher income earners are taxed at higher rates. The system is reviewed annually by Nepal’s tax authorities, with the 2025 structure incorporating several significant changes aimed at boosting revenue collection while supporting economic growth.

Historical Context of Nepal’s Tax System

Nepal’s tax system has evolved significantly over the past decades. The current Tax Slab Nepal 2025 builds upon reforms initiated in the early 2000s, with periodic adjustments to reflect economic changes and policy priorities. The progressive tax structure was introduced to ensure equitable distribution of tax burdens across different income groups.

Detailed Tax Slab Structure for 2025

The Tax Slab Nepal 2025 has been categorized into different sections based on taxpayer types and income sources. Below is a comprehensive breakdown of the current tax structure.

Individual Tax Slabs

For individual taxpayers, the Tax Slab Nepal 2025 has been structured as follows:

| Annual Income (NPR) | Tax Rate | Additional Social Security Fund |

|---|---|---|

| Up to 500,000 | 1% | NPR 100 per month |

| 500,001 – 700,000 | 10% | NPR 100 per month |

| 700,001 – 1,000,000 | 20% | NPR 100 per month |

| 1,000,001 – 2,000,000 | 30% | NPR 100 per month |

| Above 2,000,000 | 36% | NPR 100 per month |

Note: These rates apply to individual taxpayers who are below 60 years of age. Different rates may apply to senior citizens and couples filing jointly.

Corporate Tax Slabs

For businesses operating in Nepal, the Tax Slab Nepal 2025 has established the following corporate tax rates:

| Business Type | Tax Rate |

|---|---|

| Public Companies | 25% |

| Banks and Financial Institutions | 30% |

| Insurance Companies | 30% |

| Hydroelectricity Projects (Large-scale) | 20% |

| Hydroelectricity Projects (Small-scale) | 10% |

| Industries in Special Economic Zones | 15% |

| Regular Industries | 25% |

Other Tax Categories

The Tax Slab Nepal 2025 also includes provisions for other tax categories:

| Tax Type | Rate/Amount |

|---|---|

| Value Added Tax (VAT) | 13% |

| Excise Duty | Varies by product |

| Customs Duty | Varies by product |

| Property Registration | 4-8% of property value |

| Vehicle Tax | Varies by vehicle type |

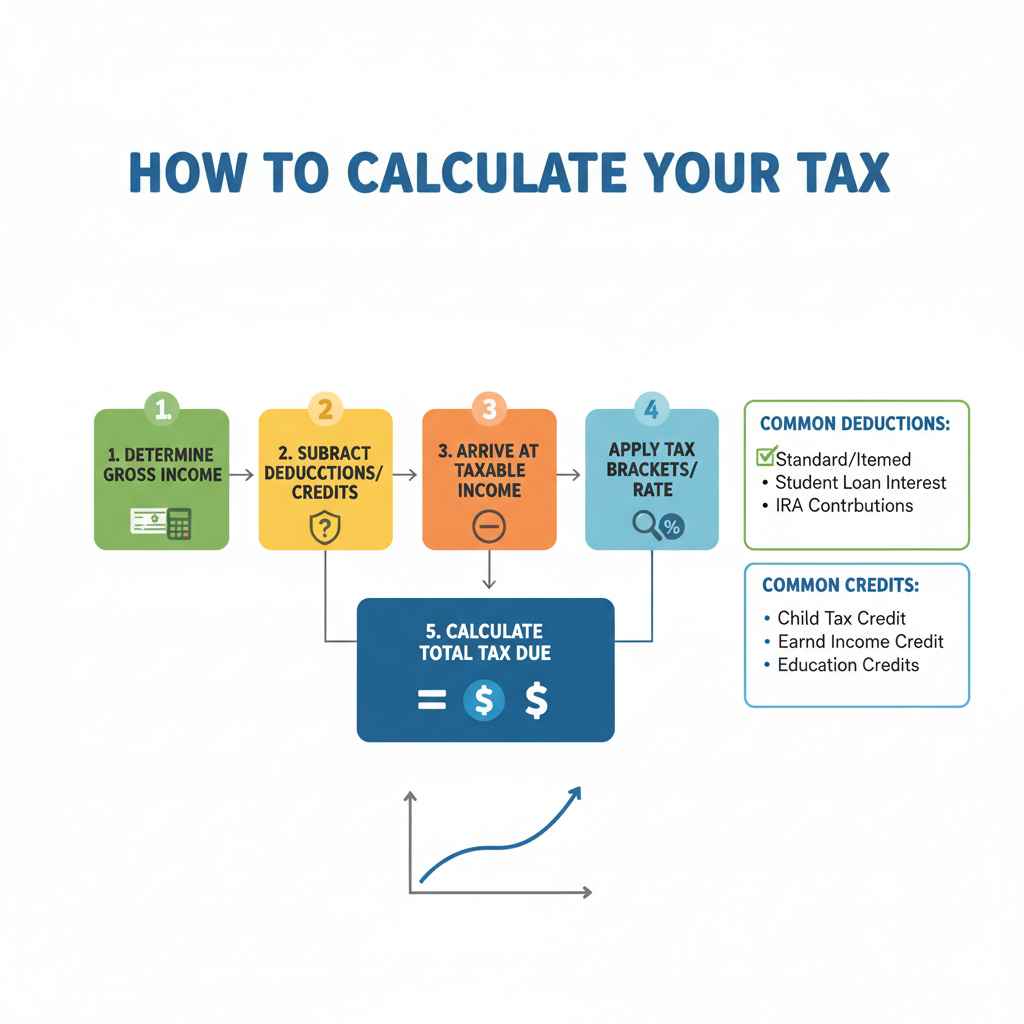

How to Calculate Your Tax

Calculating your tax according to the Tax Slab Nepal 2025 can be straightforward if you follow these steps:

- Determine your total annual income from all sources

- Identify applicable deductions and exemptions

- Calculate your taxable income

- Apply the appropriate tax rate from the relevant slab

- Add any additional taxes or cess as applicable

For example, if your annual income is NPR 800,000:

- First NPR 500,000 @ 1% = NPR 5,000

- Next NPR 200,000 @ 10% = NPR 20,000

- Remaining NPR 100,000 @ 20% = NPR 20,000

- Total tax = NPR 45,000

Read More

Recent Changes in Nepal’s Tax Policy

The Tax Slab Nepal 2025 incorporates several significant changes from previous years:

- Increased exemption limit: The tax exemption threshold has been raised from NPR 400,000 to NPR 500,000 for individuals.

- Digital taxation: New provisions for taxing digital services and e-commerce platforms.

- Green incentives: Additional tax benefits for environmentally friendly businesses and practices.

- Simplified compliance: Introduction of simplified tax procedures for small businesses and startups.

Frequently Asked Questions

Where can I find the official Tax Slab Nepal 2025 document?

The official Tax Slab Nepal 2025 document can be found on the Inland Revenue Department of Nepal’s website (www.ird.gov.np ). Additionally, printed copies are available at their offices across major cities in Nepal.

How often is the Tax Slab Nepal 2025 updated?

The tax slabs in Nepal are typically reviewed annually during the budget announcement, which usually occurs in mid-July. However, interim changes may be made through financial ordinances if necessary.

Are there any special provisions for taxpayers in remote areas of Nepal?

Yes, the Tax Slab Nepal 2025 includes special provisions for taxpayers in certain remote and underdeveloped regions of Nepal, offering additional deductions and lower tax rates to promote economic development in these areas.

How does the Tax Slab Nepal 2025 affect non-resident taxpayers?

Non-resident taxpayers are generally taxed only on their Nepal-sourced income at rates specified in the Tax Slab Nepal 2025. Double taxation avoidance agreements with certain countries may also apply.

Conclusion

Understanding the Tax Slab Nepal 2025 is essential for all taxpayers in Nepal to ensure compliance and optimize their tax planning. The progressive nature of Nepal’s tax system aims to distribute the tax burden equitably while generating necessary revenue for the country’s development. As Nepal continues to modernize its tax administration, taxpayers can expect more streamlined processes and digital services to facilitate compliance.

For personalized advice regarding your specific tax situation under the Tax Slab Nepal 2025, it is recommended to consult with a qualified tax professional or the Inland Revenue Department directly.

This blog post is intended for informational purposes only and should not be considered as legal or financial advice. Tax laws are subject to change, and readers are encouraged to consult with tax professionals for advice tailored to their specific circumstances.