What is a Tax Clearance Certificate?

A Tax Clearance Certificate (TCC) in Nepal is an official document issued by the Inland Revenue Department (IRD) that confirms a taxpayer has fulfilled all their tax obligations up to a specific date. This certificate serves as proof that an individual or business has no outstanding tax liabilities with the government. It’s an essential document for various financial and legal transactions in Nepal, demonstrating compliance with the country’s tax laws and regulations.

The TCC is not just a piece of paper; it’s a testament to a taxpayer’s financial responsibility and good standing with the tax authorities. For businesses, it can be crucial for participating in government tenders, renewing licenses, or securing loans. For individuals, it may be required for certain property transactions or visa applications. Understanding the importance and process of obtaining a TCC is vital for anyone conducting business or financial affairs in Nepal.

Who Needs to Obtain a Tax Clearance Certificate?

In Nepal, various individuals and entities are required to obtain a Tax Clearance Certificate. These include:

- Registered businesses and companies

- Self-employed professionals

- Non-governmental organizations (NGOs)

- International non-governmental organizations (INGOs)

- Government contractors and suppliers

- Individuals involved in specific financial transactions

- Foreign investors or companies operating in Nepal

Businesses typically need a TCC annually to comply with regulatory requirements and participate in government bids. Professionals such as doctors, lawyers, and consultants may need it for license renewals. NGOs and INGOs often require TCCs for registration renewals and fund transfers. Government contractors need it to bid on projects or receive payments. Individuals might need a TCC for high-value property transactions or when applying for certain types of visas.

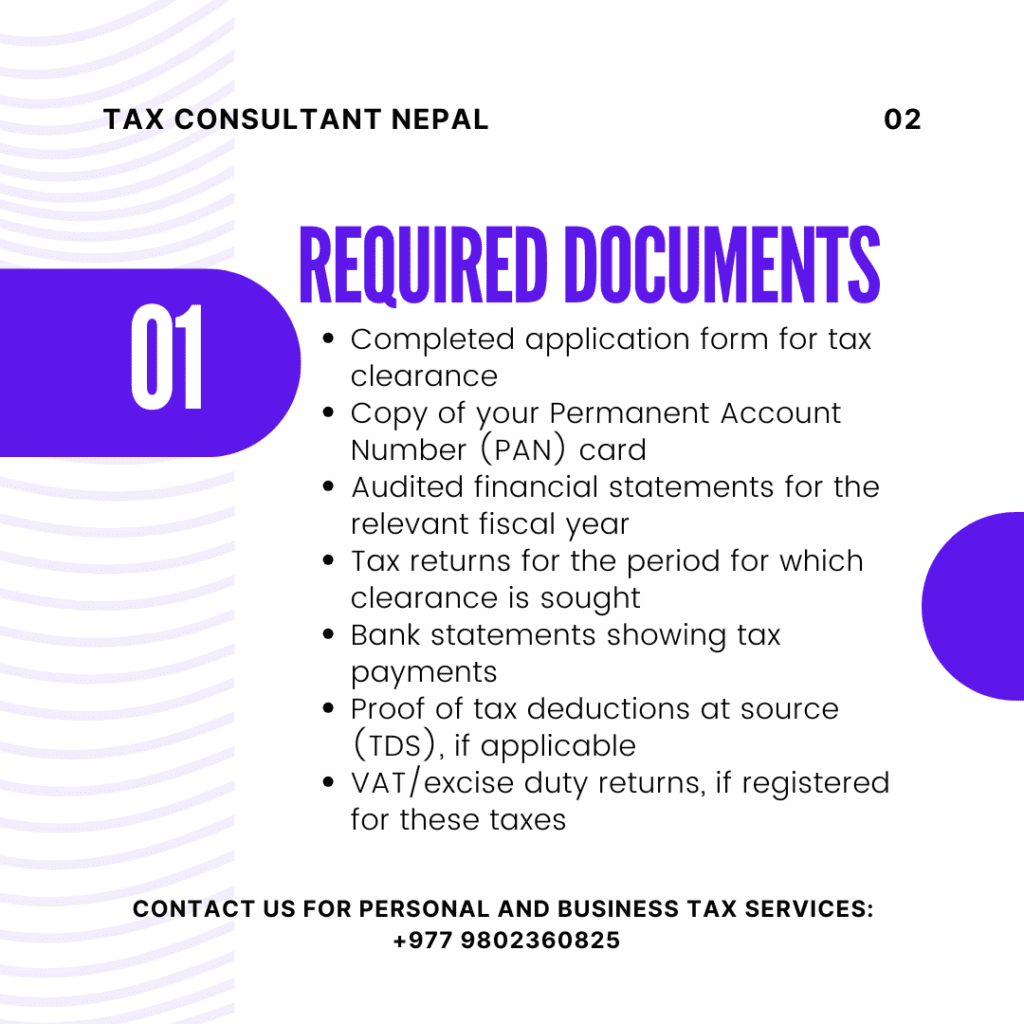

What Documents are Required for Tax Clearance?

To obtain a Tax Clearance Certificate in Nepal, you’ll need to prepare and submit several documents. The exact requirements may vary depending on your tax status and the nature of your business, but generally, you’ll need:

- Completed application form for tax clearance

- Copy of your Permanent Account Number (PAN) card

- Audited financial statements for the relevant fiscal year

- Tax returns for the period for which clearance is sought

- Bank statements showing tax payments

- Proof of tax deductions at source (TDS), if applicable

- VAT/excise duty returns, if registered for these taxes

For businesses, additional documents may include the company registration certificate, shareholder details, and board resolutions. Self-employed individuals might need to provide income statements and expense records. It’s crucial to ensure all financial records are up-to-date and accurately reflect your tax situation. Gathering these documents in advance can significantly streamline the application process.

How to Apply for Tax Clearance Certificate?

Applying for a Tax Clearance Certificate in Nepal involves a straightforward process, which can be done both online and offline. Here’s a step-by-step guide:

- Online Application:

- Visit the Inland Revenue Department’s official website

- Log in to your taxpayer account

- Navigate to the tax clearance certificate application section

- Fill out the online application form

- Upload the required documents

- Submit the application

- Offline Application:

- Obtain the application form from your local tax office

- Fill out the form with accurate information

- Gather all necessary documents

- Submit the completed form and documents to the tax office

- Verification:

- Ensure all information provided is correct and up-to-date

- Double-check that all required documents are included

- Follow-up:

- Keep track of your application using the provided reference number

- Be prepared to provide additional information if requested

- Payment:

- Pay any required fees as instructed by the tax office

Remember to apply well in advance of when you need the certificate, as processing times can vary. If you’re unsure about any part of the application, don’t hesitate to seek guidance from the tax office or a professional tax consultant.

Relevant Articles:

- File Income Tax Return in Nepal

- How to Apply for Tax Refund in Nepal

- How to Calculate and Pay Advance Tax in Nepal

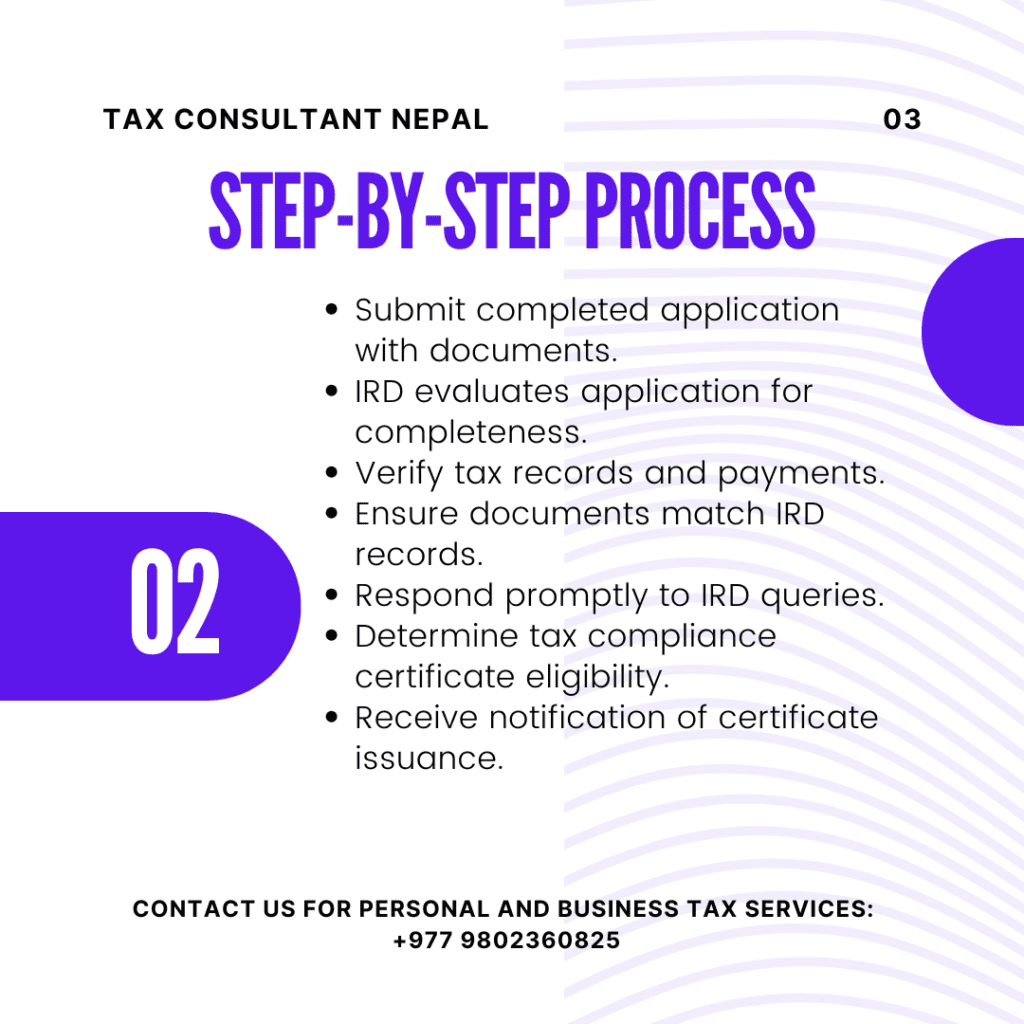

What is the Process of Obtaining Clearance?

The process of obtaining a Tax Clearance Certificate in Nepal involves several steps and typically requires interaction with the Inland Revenue Department (IRD). Here’s a detailed overview of the process:

- Application Submission: After preparing all necessary documents, submit your application either online through the IRD portal or in person at your local tax office. Ensure all information is accurate and complete to avoid delays.

- Initial Review: The tax office conducts a preliminary review of your application and documents. They check for completeness and accuracy of the information provided.

- Tax Compliance Check: The IRD performs a thorough review of your tax records. This includes verifying past tax returns, checking for any outstanding tax liabilities, and confirming that all required taxes have been paid.

- Document Verification: The submitted documents are scrutinized to ensure they match the information in the IRD’s records. This may include cross-checking financial statements, bank records, and tax payment receipts.

- Clarification Requests: If there are any discrepancies or additional information needed, the IRD will contact you. Be prepared to provide explanations or additional documents promptly.

- Final Assessment: Once all verifications are complete and any issues resolved, the IRD makes a final assessment of your tax compliance status.

- Certificate Issuance: If everything is in order, the Tax Clearance Certificate is issued. You’ll be notified when it’s ready for collection or, in some cases, it may be sent electronically.

Throughout this process, it’s important to maintain open communication with the tax office. Responding quickly to any queries or requests for additional information can significantly speed up the process. The time frame for obtaining the certificate can vary depending on the complexity of your tax situation and the current workload of the tax office.

How Long Does it Take to Get Certificate?

The time it takes to obtain a Tax Clearance Certificate in Nepal can vary depending on several factors. Generally, the process can take anywhere from a few days to several weeks. Here’s a breakdown of the typical timeframes:

- Simple Cases: For individuals or small businesses with straightforward tax affairs and no outstanding issues, the process may take 3-7 working days.

- Complex Cases: Larger businesses or those with more complex tax situations might need to wait 2-4 weeks for their certificate.

- Peak Seasons: During busy periods, such as the end of the fiscal year, processing times may be longer due to high volume of applications.

- Incomplete Applications: If your application is missing information or requires additional documentation, this can significantly extend the processing time.

- Tax Disputes: If you have any ongoing tax disputes or unresolved issues with the IRD, obtaining the certificate may take longer.

Factors that can influence the processing time include the completeness of your application, the accuracy of your tax records, and the current workload of the tax office. To expedite the process, ensure all your documents are in order and respond promptly to any queries from the tax office. It’s advisable to apply for the certificate well in advance of when you need it to account for any potential delays.

What are Fees for Tax Clearance Certificate?

The fees for obtaining a Tax Clearance Certificate in Nepal are generally minimal, but they can vary depending on the type of entity applying and the purpose of the certificate. Here’s an overview of the typical fee structure:

- Individual Taxpayers: For personal tax clearance certificates, the fee is usually nominal, often around NPR 100-200.

- Small Businesses: Small enterprises may be charged a slightly higher fee, typically ranging from NPR 200-500.

- Large Corporations: Larger companies or those with complex tax structures might face higher fees, potentially up to NPR 1000-2000.

- NGOs and INGOs: Non-profit organizations often have a separate fee structure, which can be similar to small businesses.

- Expedited Processing: Some offices may offer faster processing for an additional fee, which could range from NPR 500-1000.

- Purpose-specific Fees: The fee might vary based on the purpose of the certificate (e.g., for bidding, for foreign employment).

- Renewal Fees: Renewal of an existing certificate may have a different fee structure, often slightly lower than a new application.

It’s important to note that these fees are subject to change and may vary slightly between different tax offices. Always check with your local Inland Revenue Department office for the most up-to-date fee information. Additionally, remember that the fee is typically a small fraction of the overall cost of compliance, which includes preparing accurate financial statements and tax returns.

How to Renew Tax Clearance Certificate?

Renewing a Tax Clearance Certificate in Nepal is a process similar to obtaining the initial certificate, but it’s often more streamlined. Here’s a guide on how to renew your TCC:

- Timing: Start the renewal process at least a month before your current certificate expires to ensure continuous coverage.

- Document Preparation: Gather updated financial documents, including:

- Latest audited financial statements

- Recent tax returns

- Proof of tax payments for the new period

- Application Submission:

- Fill out the renewal application form

- Submit it along with the updated documents to your local tax office or through the online portal

- Compliance Check: The tax office will review your recent tax compliance history and current status.

- Address Any Issues: If there are any discrepancies or outstanding taxes, address them promptly to avoid delays.

- Fee Payment: Pay the renewal fee as stipulated by the tax office.

- Collection: Once approved, collect your renewed certificate from the tax office or download it if provided electronically.

Remember, maintaining good tax compliance throughout the year can make the renewal process much smoother. Keep accurate records and file taxes on time to avoid complications during renewal.

What are Consequences of Not Obtaining Certificate?

Failing to obtain or renew a Tax Clearance Certificate in Nepal can have serious consequences for individuals and businesses. Here are the key repercussions:

- Legal Non-Compliance: Operating without a valid TCC puts you in violation of Nepal’s tax laws.

- Business Restrictions: You may be barred from participating in government tenders or contracts.

- License Issues: Renewal of business licenses and permits can be denied or delayed.

- Financial Limitations: Banks may refuse loans or other financial services without a current TCC.

- Penalties: The government can impose fines or penalties for non-compliance.

- Audit Risks: Businesses without a TCC are more likely to face detailed tax audits.

- Reputational Damage: Lack of a TCC can harm your business’s reputation with partners and clients.

Not having a Tax Clearance Certificate can significantly hinder your business operations and personal financial transactions in Nepal. It’s a clear indicator of your tax compliance status, and its absence can raise red flags with various authorities and business partners. To avoid these consequences, it’s crucial to prioritize obtaining and maintaining a valid Tax Clearance Certificate.

How to Check Status of Clearance Application?

Checking the status of your Tax Clearance Certificate application in Nepal is an important step in ensuring a smooth process. Here are the methods you can use to track your application:

- Online Portal:

- Log into the Inland Revenue Department’s official website

- Navigate to the application status section

- Enter your application reference number

- View the current status of your application

- SMS Service:

- Some tax offices offer SMS updates

- Register your mobile number during application

- Receive text messages about your application progress

- Phone Inquiry:

- Call your local tax office directly

- Provide your application number and personal details

- Ask for an update on your application status

- In-Person Visit:

- Visit the tax office where you submitted your application

- Bring your application receipt and identification

- Inquire about your application status at the information desk

- Email Follow-up:

- Some offices accept email inquiries

- Send an email with your application details to the provided address

- Wait for a response with your application status

Remember to keep your application number handy when checking the status. If there are any issues or additional requirements, respond promptly to avoid delays. Regular follow-ups can help ensure your application is processed efficiently and any potential problems are addressed quickly.

How to get a tax clearance certificate in Nepal?

1. Submit a tax return to the Inland Revenue Office (IRO).

2. Clear all outstanding tax liabilities.

3. Apply through the IRO online portal or visit the office.

4. Receive the tax clearance certificate upon approval.

How can I get a tax clearance certificate?

1. Determine the type of clearance certificate (tax, police, or financial).

2. Submit necessary documents to the relevant authority.

3. Pay applicable fees if required.

4. Obtain the clearance certificate after verification.

How to get a tax return in Nepal?

1. File your income tax return via the Inland Revenue Department (IRD) online system.

2. Ensure all taxable income is reported.

3. Claim applicable deductions and tax credits.

4. Submit the return before the deadline to avoid penalties.

What is TDS in Nepal?

TDS (Tax Deducted at Source) is a tax collected by the payer on specific payments such as salaries, rent, interest, dividends, and service fees. The applicable TDS rates vary based on the type of income and recipient status. The deducted tax must be deposited with the IRD within the specified deadline to comply with Nepal’s tax regulations.

How to pay tax online in Nepal?

1. Visit the IRD e-payment portal or use mobile banking/eSewa/Khalti.

2. Enter tax details and verify payment amount.

3. Use a registered bank account for the transaction.

4. Receive an online confirmation receipt after payment.

How do I get online tax clearance?

1. Log in to the IRD Taxpayer Portal.

2. Ensure all tax filings and payments are up to date.

3. Submit a tax clearance request online.

4. Download the tax clearance certificate once approved.

Related posts:

- https://taxconsultantnepal.com/branch-office-registration-in-nepal-contact-liaison-office/

- https://lawaxion.com/non-resident-nepali-nrn-id-card-in-nepal/

- https://lawaxion.com/education-consultancy-license-process-in-nepal/

- https://companynp.com/travel-and-tours-company-registration-in-nepal/

- https://taxconsultantnepal.com/export-import-license-process-in-nepal/

- https://lawaxion.com/manpower-license-process-in-nepal/

- https://taxconsultantnepal.com/nrn-citizenship-process-in-nepal-2025-2/

- https://taxconsultantnepal.com/non-profit-organization-registration-process-in-nepal/

- https://companynp.com/trademark-registration-process-in-nepal/

- https://taxconsultantnepal.com/company-registration-process-in-nepal/

- https://lawaxion.com/foreign-direct-investment-approval-process-in-nepal/

- https://lawaxion.com/criteria-for-five-star-hotel-in-nepal/