Steps to Register a New Business in Nepal

Are you thinking about starting a business in Nepal? Congratulations on taking this exciting step! Registering your business is a crucial part of the process, and we’re here to guide you through it. In this article, we’ll break down the steps to register a new business in Nepal, making it easy for you to understand and follow.

What are the types of registrable Businesses in Nepal?

Before diving into the registration process, it’s important to know what types of businesses you can register in Nepal. The country offers several options to suit different needs and goals:

- Private Limited Company

- Public Limited Company

- Partnership Firm

- Sole Proprietorship

- Non-Governmental Organization (NGO)

- International Non-Governmental Organization (INGO)

- Branch Office of Foreign Company

Each type has its own advantages and requirements. For example, a Sole Proprietorship is the simplest to set up but offers no liability protection, while a Private Limited Company provides more protection but requires more paperwork. Think about your business goals and consult with a professional to choose the best fit for you.

What is the Step-By-Step Process of Registering Business in Nepal?

Now, let’s walk through the process of registering your business in Nepal. Don’t worry, we’ll break it down into manageable steps!

- Choose your business structure: Decide which type of business entity suits your needs best.

- Select a unique business name: Pick a name that’s not already taken and follows Nepal’s naming rules.

- Prepare required documents: Gather all necessary paperwork (we’ll cover this in detail later).

- Submit documents to the Company Registrar’s Office: File your application and supporting documents.

- Pay the registration fee: The amount varies based on your business type and capital.

- Obtain the registration certificate: Once approved, you’ll receive your official registration.

- Register for VAT/PAN: Apply for your Permanent Account Number (PAN) or Value Added Tax (VAT) number.

This process might seem daunting, but take it one step at a time. Remember, you’re laying the foundation for your business’s future success!

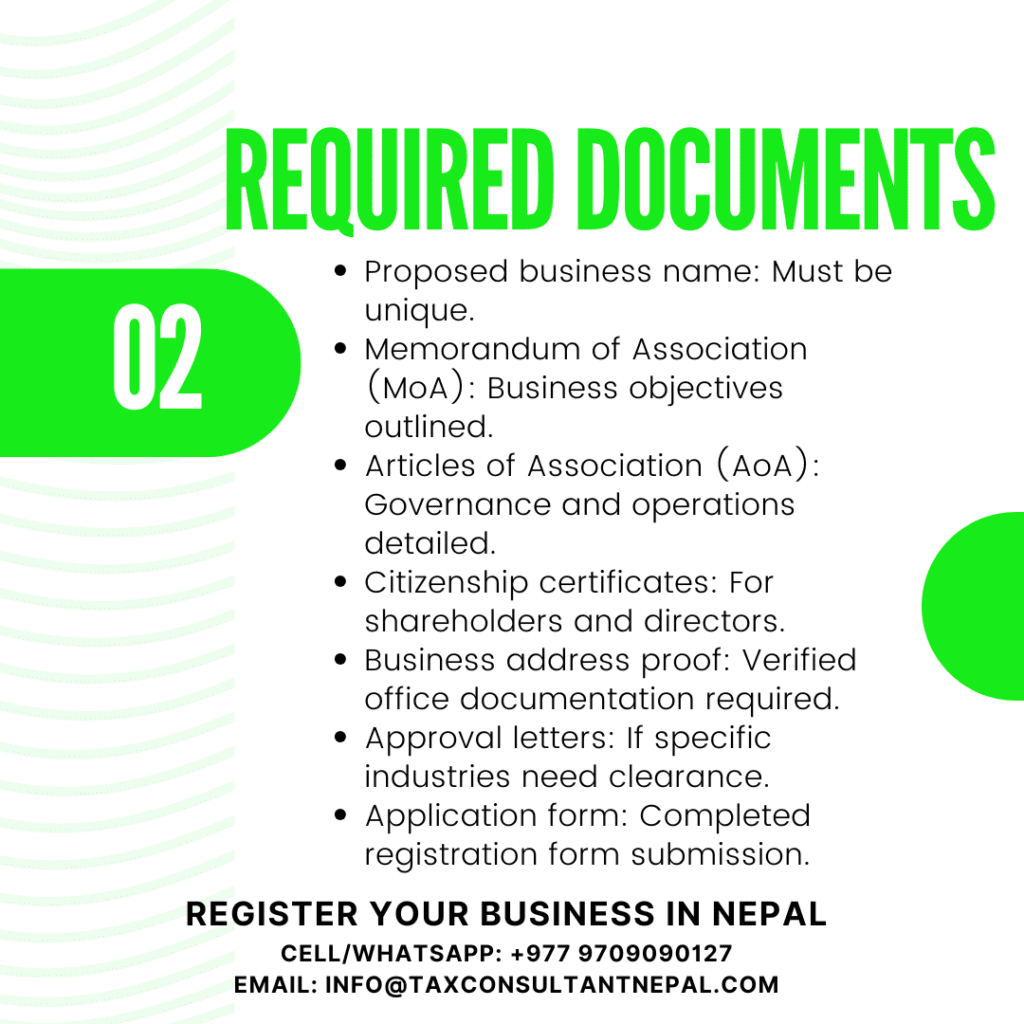

What documents are required to register a New Business in Nepal?

Getting your paperwork in order is crucial for a smooth registration process. Here’s a list of documents you’ll typically need:

- Application form (available at the Company Registrar’s Office)

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Citizenship certificates of all promoters/partners

- Passport-sized photos of all promoters/partners

- No Objection Letters from promoters/partners

- Resolution of the Board of Directors (for companies)

Keep in mind that requirements may vary slightly depending on your business type. It’s always a good idea to check with the Company Registrar’s Office or a legal professional to ensure you have everything you need.

How long does business registration take?

Wondering how long you’ll need to wait before your business is officially registered? The good news is that Nepal has been working to streamline the process in recent years. On average, it takes about 2-3 weeks to complete the registration process. However, this timeline can vary based on factors like:

- The type of business you’re registering

- The completeness and accuracy of your submitted documents

- The current workload of the registering office

To speed things up, make sure all your documents are in order before submission. If possible, consider using online registration services, which can sometimes be faster than traditional methods.

Where to submit business registration documents?

Ready to submit your documents? Here’s where you need to go:

For most businesses, you’ll submit your registration documents to the Office of Company Registrar (OCR). The main office is located in Kathmandu, but there are also branch offices in other major cities like Pokhara and Biratnagar.

If you’re registering a Sole Proprietorship, you’ll need to go to the Department of Cottage and Small Industries (DCSI) or the Department of Industry (DOI), depending on your business size.

For NGOs and INGOs, registration is handled by the Social Welfare Council (SWC).

Remember to call ahead or check their website for current operating hours and any appointment requirements.

What is the cost of registering?

Let’s talk about the financial aspect of registering your business. The cost of registration in Nepal varies depending on several factors:

- Type of business entity

- Authorized capital (for companies)

- Registration fees

- Lawyer or consultant fees (if you choose to use their services)

For example, registering a Private Limited Company with an authorized capital of up to NPR 1 million typically costs around NPR 9,500. This includes the registration fee and other associated costs.

Here’s a rough breakdown of costs for different business types:

- Sole Proprietorship: NPR 1,000 – 3,000

- Partnership Firm: NPR 5,000 – 10,000

- Private Limited Company: NPR 9,500 – 15,000 (varies with capital)

- Public Limited Company: Starting from NPR 25,000 (varies significantly with capital)

Remember, these are just estimates. Actual costs may vary, and there might be additional expenses for things like notarization or document preparation. It’s always a good idea to set aside a little extra to cover any unexpected fees.

Relevant Articles:

- Filing Tax on Rental Income in Nepal

- Steps to File for GST in Nepal

- Business Expense Deduction in Nepal

How to choose a business name?

Choosing the right name for your business is more than just a creative exercise – it’s also a legal requirement. Here are some tips to help you pick a great name that complies with Nepal’s regulations:

- Be unique: Your business name must be different from any existing registered business.

- Avoid restricted words: Certain words like “Bank,” “Insurance,” or “Royal” may require special permission.

- Keep it relevant: The name should reflect your business activities.

- Check availability: Search the Company Registrar’s database to ensure your chosen name isn’t taken.

- Consider language: Names in Nepali are allowed, but an English translation must be provided.

- Think about branding: Choose a name that’s easy to remember and pronounce.

- Future-proof it: Pick a name that allows for potential growth and expansion.

Once you’ve chosen a name, you can reserve it with the Company Registrar’s Office for a small fee. This holds the name for you while you complete the rest of the registration process.

What types of businesses can be registered?

Nepal offers a variety of business structures to choose from, each with its own advantages and requirements. Let’s explore the main types:

- Sole Proprietorship: Perfect for individual entrepreneurs. It’s the simplest to set up but offers no liability protection.

- Partnership Firm: Ideal for two or more individuals who want to run a business together. Partners share profits and liabilities.

- Private Limited Company: A popular choice for small to medium businesses. It offers liability protection and can have up to 101 shareholders.

- Public Limited Company: Suitable for larger businesses. It can have unlimited shareholders and can be listed on the stock exchange.

- Non-Profit Organization: For those looking to make a social impact without profit motives.

- Foreign Company Branch: For international companies wanting to establish a presence in Nepal.

- Representative Office: A non-trading presence for foreign companies to explore the Nepali market.

Each type has its own registration process, capital requirements, and regulatory obligations. Consider your business goals, financial situation, and long-term plans when choosing the right structure for you.

Is online registration available for businesses?

Good news for tech-savvy entrepreneurs! Nepal has been modernizing its business registration process, and online registration is now available for certain types of businesses. Here’s what you need to know:

- Online registration is primarily available for Private Limited Companies and Sole Proprietorships.

- The process is managed through the Office of Company Registrar’s online portal.

- You’ll need to create an account on the portal and follow the step-by-step instructions.

- Some documents may still need to be submitted in person or by mail.

- Online registration can be faster and more convenient than traditional methods.

While online registration is becoming more common, it’s not yet available for all business types. Complex structures like Public Limited Companies or foreign company registrations may still require in-person submissions.

Remember, even if you start the process online, you might need to visit the office to complete certain steps or provide original documents. Always check the latest information on the official government websites or consult with a legal professional for the most up-to-date procedures.

What government offices handle business registration?

Navigating government offices can be tricky, but knowing where to go is half the battle. Here are the main government offices involved in business registration in Nepal:

- Office of Company Registrar (OCR): The primary office for registering most types of companies.

- Department of Industry (DOI): Handles registration for medium and large-scale industries.

- Department of Cottage and Small Industries (DCSI): Manages registration for small and cottage industries.

- Inland Revenue Department (IRD): Where you’ll register for your PAN or VAT number.

- Social Welfare Council (SWC): Responsible for registering NGOs and INGOs.

- Nepal Rastra Bank (NRB): Involved in registering financial institutions.

- Local Municipality Offices: Often involved in registering sole proprietorships.

Remember, the specific office you’ll deal with depends on your business type and size. It’s always a good idea to start with the Office of Company Registrar or your local municipality office if you’re unsure. They can guide you to the right department for your specific needs.

What is the Business Registration Process for Foreign Investors?

Nepal welcomes foreign investment, but the process for foreign investors to register a business has a few additional steps. Here’s an overview:

- Obtain approval from the Department of Industry (DOI) or Investment Board Nepal (IBN), depending on the investment amount.

- Register the company with the Office of Company Registrar (OCR).

- Apply for a business visa at the Department of Immigration.

- Register with the Inland Revenue Department for tax purposes.

- Obtain industry-specific licenses if required.

- Open a local bank account and transfer the investment amount.

- Register with the Nepal Rastra Bank to record the foreign investment.

Foreign investors can own up to 100% of a company in most sectors, but some areas have restrictions or are closed to foreign investment. It’s crucial to research these regulations or consult with a local legal expert before proceeding.

The minimum investment amount for foreign investors is currently set at NPR 50 million (about USD 420,000), but this can vary for different sectors.

Remember, while Nepal encourages foreign investment, the process can be complex. Consider partnering with a local consultant or lawyer to navigate the regulations and cultural nuances effectively.

How to obtain a business PAN number?

Getting a Permanent Account Number (PAN) is a crucial step in setting up your business in Nepal. Here’s how to do it:

- Gather necessary documents: You’ll need your business registration certificate, citizenship certificates of owners/directors, and other relevant papers.

- Visit the Inland Revenue Department (IRD): Find your nearest IRD office.

- Fill out the PAN registration form: This is available at the IRD office or can be downloaded from their website.

- Submit the form and documents: Make sure everything is complete to avoid delays.

- Pay the registration fee: The fee is minimal, usually around NPR 200.

- Receive your PAN certificate: This usually takes a few days to process.

- Register for VAT if applicable: If your annual turnover exceeds NPR 5 million, you’ll need to register for Value Added Tax (VAT) as well.

Your PAN is essential for tax purposes and many other business operations in Nepal. It’s often required for opening bank accounts, applying for loans, or bidding on government contracts.

Remember, once you have your PAN, you’re required to file tax returns annually, even if your business doesn’t make a profit. Staying compliant with tax regulations is crucial for your business’s long-term success in Nepal.

By following these steps and understanding the process, you’ll be well on your way to successfully registering your business in Nepal. Remember, while this guide provides a comprehensive overview, regulations can change. Always verify the latest requirements with official sources or consult with a local business expert for the most up-to-date information. Good luck with your new business venture!

How to Register a Business in Nepal?

Step 1: Choose a Business Name and Structure

Step 2: Registration of Business at OCR or Commerce or Small Industries

Step 3: Registration at Tax and Ward Office

Step 4: Obtaining Certificate of Business Registration

Step 5: Approval and License for Legal business Operation in Nepal

Where do I register my business in Nepal?

Businesses must be registered at the Office of the Company Registrar (OCR) or Department of Small Industries or Department of Commerce, which are responsible for company registration and related licensing & approvals.

What documents are required to register a business in Nepal?

You need a proposed company name, Memorandum and Articles of Association, citizenship certificates of shareholders, business address proof, and evidence of the registered office to complete the business registration process.

How long does it take to register a business in Nepal?

The business registration process typically takes five to ten working days after submitting all required documents to the Office of the Company Registrar and fulfilling the necessary formalities.

Can a foreigner register a business in Nepal?

Foreigners can register businesses in Nepal, but prior approvals may be required from the Department of Industry or Foreign Investment Promotion Board, depending on the nature and scope of the investment.

What is the cost of registering a business in Nepal?

The registration cost varies based on the company’s authorized capital, ranging from NPR 20,000 to NPR 45,000 or higher for larger enterprises, as specified by government regulations.

Do I need to renew my business registration annually?

Yes, businesses must renew registration annually by submitting updated reports and paying renewal fees to the Office of the Company Registrar to maintain compliance and legal operation.