What is payroll processing service in Nepal?

Payroll processing service in Nepal refers to the comprehensive management of employee compensation, including salary calculations, tax deductions, and benefit allocations. This service ensures accurate and timely payment of employees while complying with Nepal’s labor laws and tax regulations. Payroll processing involves a series of tasks such as calculating wages, withholding taxes, maintaining records, and generating reports for both employers and employees.

In Nepal, payroll processing services have gained popularity among businesses of all sizes due to the complexity of tax laws and the need for accurate financial record-keeping. These services help companies streamline their payroll operations, reduce errors, and ensure compliance with local regulations.

Why do businesses need payroll processing services?

Businesses in Nepal opt for payroll processing services for several reasons:

- Compliance: Payroll processing services ensure adherence to Nepal’s labor laws and tax regulations, reducing the risk of legal issues and penalties.

- Time-saving: Outsourcing payroll allows businesses to focus on core activities while experts handle complex payroll tasks.

- Accuracy: Professional services minimize errors in calculations, reducing the likelihood of employee disputes and financial discrepancies.

- Cost-effectiveness: Outsourcing can be more economical than maintaining an in-house payroll department, especially for small and medium-sized enterprises.

- Expertise: Payroll service providers stay updated with changing regulations and tax laws, ensuring businesses remain compliant.

- Confidentiality: Professional services maintain the privacy of sensitive employee information.

- Technology: Payroll services often use advanced software, providing businesses with access to better tools and reporting capabilities.

What are the components of payroll processing?

Payroll processing in Nepal typically includes the following components:

- Salary calculation: Computing basic salary, allowances, and deductions.

- Tax deductions: Calculating and withholding income tax as per Nepal’s tax laws.

- Social Security Fund (SSF) contributions: Managing employee and employer contributions to the SSF.

- Provident Fund: Calculating and managing contributions to the Provident Fund.

- Leave management: Tracking employee leave and adjusting payroll accordingly.

- Overtime calculations: Computing overtime pay as per Nepal’s labor laws.

- Bonus calculations: Managing festival bonuses and performance-based incentives.

- Loan and advance management: Handling salary advances and loan repayments.

- Payslip generation: Creating detailed payslips for employees.

- Reporting: Generating various reports for management, auditors, and government authorities.

How does payroll processing work in Nepal?

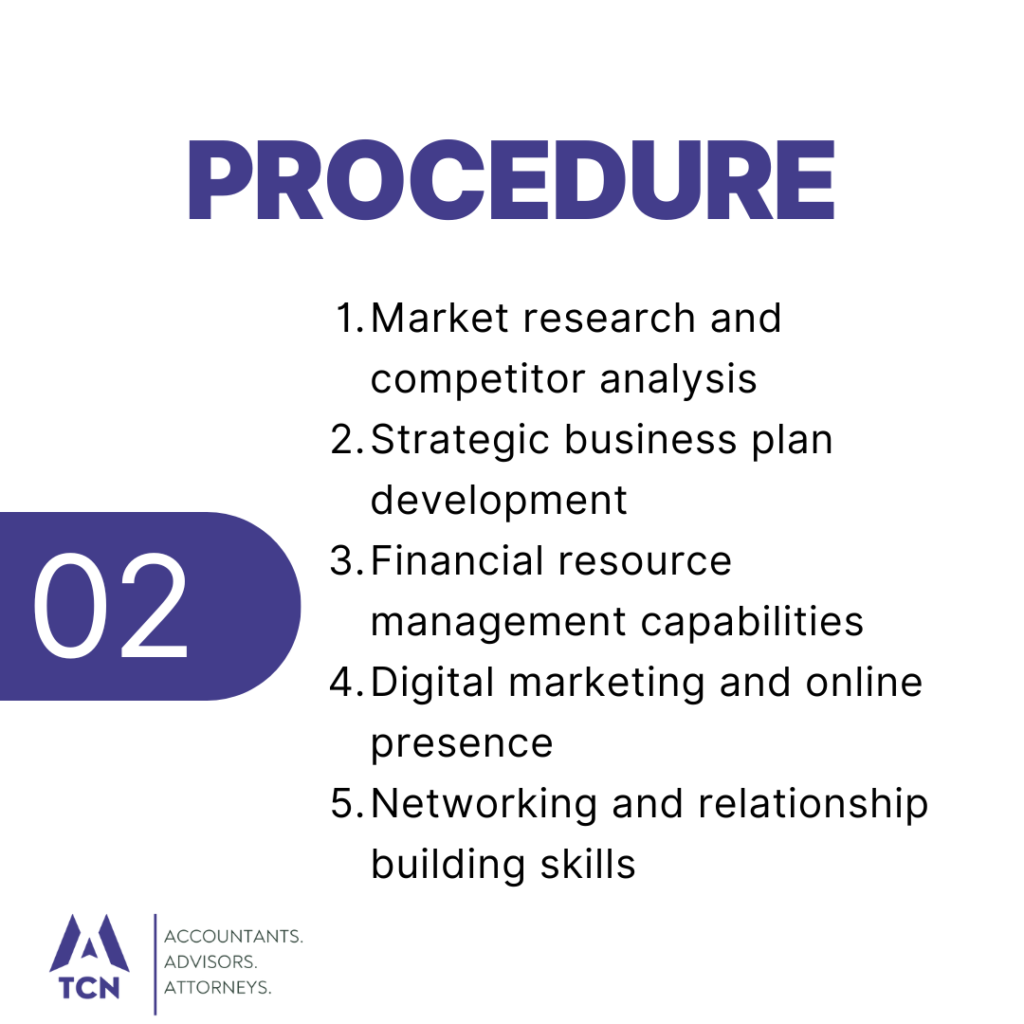

Payroll processing in Nepal typically follows these steps:

- Data collection: Gathering employee information, attendance records, and other relevant data.

- Salary calculation: Computing gross salary based on basic pay, allowances, and deductions.

- Tax calculation: Determining income tax liability as per Nepal’s tax slabs and regulations.

- Deductions: Applying statutory deductions like SSF, Provident Fund, and any other applicable deductions.

- Net salary computation: Calculating the final take-home pay after all deductions.

- Bank transfer preparation: Creating bank transfer files for salary disbursement.

- Payslip generation: Producing detailed payslips for each employee.

- Reporting: Generating various reports for internal and external use.

- Compliance: Ensuring all statutory requirements are met and filing necessary returns.

What are the legal requirements for payroll in Nepal?

Payroll processing in Nepal must comply with several legal requirements:

- Labor Act 2074 (2017): Governs employment terms, working hours, leave, and other labor-related matters.

- Income Tax Act 2058 (2002): Regulates income tax calculations and deductions.

- Social Security Act 2074 (2017): Mandates contributions to the Social Security Fund.

- Bonus Act 2030 (1974): Outlines rules for bonus payments to employees.

- Provident Fund Act 2019 (1962): Regulates contributions to the Provident Fund.

- Minimum Wage regulations: Ensures compliance with minimum wage standards set by the government.

- Electronic Transaction Act 2063 (2006): Governs electronic transactions and digital signatures in payroll processing.

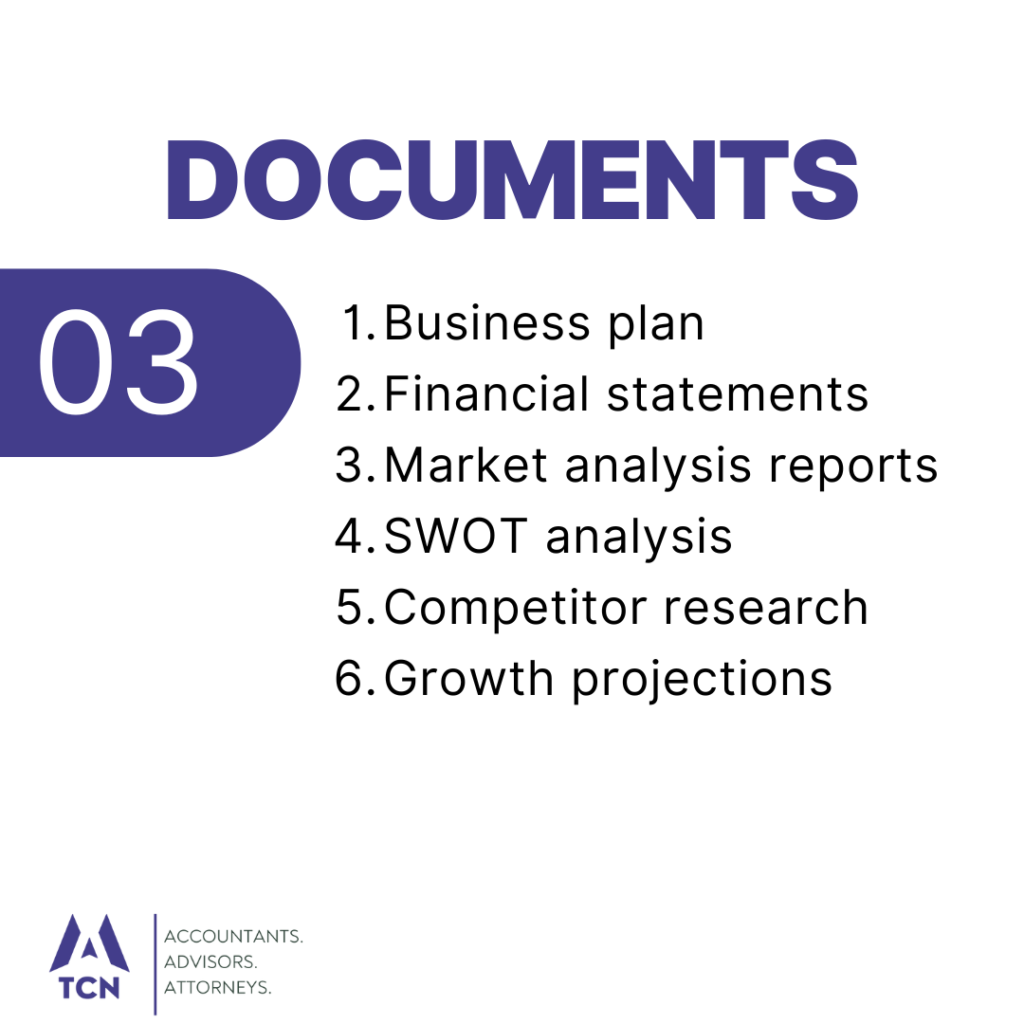

What documents are needed for payroll processing?

The following documents are typically required for payroll processing in Nepal:

- Employee personal information forms

- Employment contracts

- Attendance records

- Leave application forms

- Tax declaration forms (PAN cards)

- Bank account details

- Social Security Fund registration documents

- Provident Fund registration documents

- Overtime approval forms

- Bonus calculation sheets

- Loan and advance request forms

- Salary increment letters

- Performance appraisal reports

How often is payroll processed in Nepal?

In Nepal, payroll is typically processed on a monthly basis. However, the frequency can vary depending on the company’s policies and industry norms. Some organizations may process payroll bi-weekly or weekly, especially for certain categories of employees like daily wage workers.

The Labor Act 2074 (2017) stipulates that salaries should be paid within 7 days from the end of the wage period. Most companies in Nepal adhere to this by processing payroll at the end of each month and disbursing salaries within the first week of the following month.

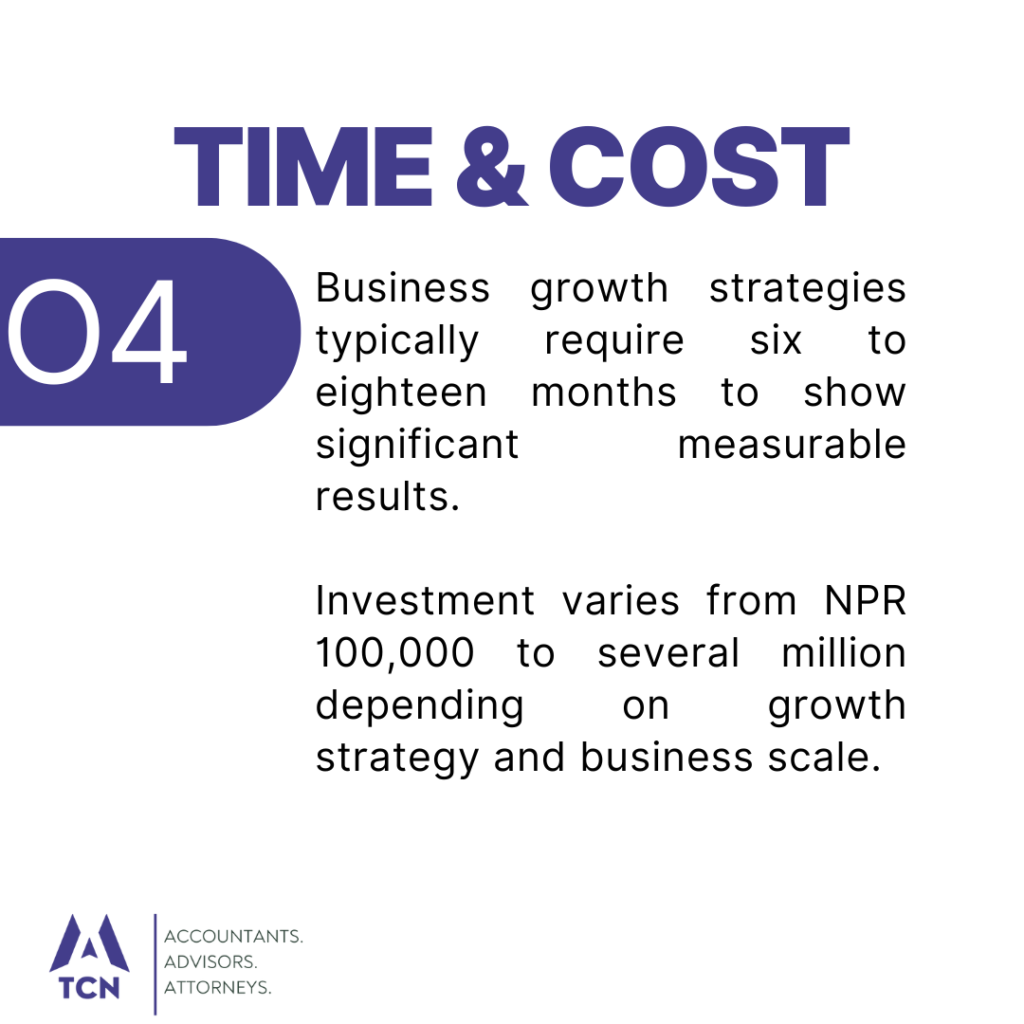

What are the costs associated with payroll processing services?

The costs of payroll processing services in Nepal can vary based on several factors:

- Number of employees: Most service providers charge based on the number of employees processed.

- Frequency of payroll: Monthly processing is standard, but more frequent processing may incur additional costs.

- Complexity of payroll: Additional services like managing multiple allowances or complex tax structures may increase costs.

- Additional services: Costs may increase for services like tax filing, report generation, or employee self-service portals.

- Software used: Advanced payroll software may come at a higher cost.

- Service provider’s reputation and expertise: Well-established firms may charge premium rates for their services.

Typically, costs can range from NPR 100 to NPR 500 per employee per month, depending on the factors mentioned above. Some providers may also charge a base fee plus a per-employee rate.

What software is commonly used for payroll processing?

Several payroll software options are available in Nepal:

- Hamro Payroll: A Nepal-specific payroll software that integrates local tax laws and regulations.

- Tally ERP 9: Widely used accounting software with payroll modules adapted for Nepal.

- QuickBooks: Offers payroll features that can be customized for Nepali requirements.

- SAP: Enterprise-level software used by larger corporations, with payroll modules.

- Odoo: An open-source ERP system with payroll features that can be customized for Nepal.

- Ramro Pay: A cloud-based payroll solution designed for Nepali businesses.

- PeopleSoft: Used by some multinational companies operating in Nepal.

- Xero: Cloud-based accounting software with payroll features that can be adapted for Nepal.

These software solutions often provide features like automated tax calculations, report generation, and integration with other business systems.

How are taxes handled in payroll processing?

Tax handling in payroll processing in Nepal involves several steps:

- Tax slab identification: Determining the applicable tax slab based on the employee’s annual income.

- Taxable income calculation: Computing the taxable income by considering various allowances and deductions.

- Tax liability computation: Calculating the monthly tax liability based on the annual tax projection.

- Tax deduction: Withholding the calculated tax amount from the employee’s salary.

- Tax deposit: Remitting the withheld tax to the Inland Revenue Department (IRD) within the stipulated time frame.

- TDS returns: Filing Tax Deducted at Source (TDS) returns with the IRD on a trimesterly basis.

- Annual tax reconciliation: Performing year-end tax calculations and adjustments.

- Tax certificates: Issuing annual tax certificates (Form 21) to employees.

Payroll processors must stay updated with the latest tax laws and regulations to ensure accurate tax handling.

What are the benefits of outsourcing payroll processing?

Outsourcing payroll processing in Nepal offers several benefits:

- Compliance assurance: Professional services ensure adherence to complex and changing labor laws and tax regulations.

- Cost savings: Reduces the need for in-house payroll staff and infrastructure.

- Time efficiency: Frees up internal resources to focus on core business activities.

- Expertise access: Leverages the knowledge of payroll specialists familiar with Nepali regulations.

- Reduced errors: Professional services minimize calculation mistakes and compliance oversights.

- Enhanced security: Reputable providers offer robust data protection measures.

- Technology advantage: Access to advanced payroll software without direct investment.

- Scalability: Easily adapts to business growth or seasonal fluctuations.

- Timely processing: Ensures consistent and punctual salary disbursements.

- Comprehensive reporting: Provides detailed payroll reports for management and compliance purposes.

How is employee data protected in payroll processing?

Employee data protection in payroll processing is crucial. In Nepal, this is typically ensured through:

- Data encryption: Using advanced encryption techniques for data storage and transmission.

- Access controls: Implementing strict user authentication and authorization protocols.

- Confidentiality agreements: Binding payroll service providers with non-disclosure agreements.

- Secure data centers: Storing data in secure, often off-site locations with physical security measures.

- Regular audits: Conducting periodic security audits to identify and address vulnerabilities.

- Data backup: Maintaining secure backups to prevent data loss.

- Limited data sharing: Restricting data access to only essential personnel.

- Employee consent: Obtaining explicit consent from employees for data processing.

- Compliance with laws: Adhering to Nepal’s data protection laws and international best practices.

- Secure communication channels: Using encrypted channels for data transmission.

Non-Disclosure Agreements (NDAs) in Nepal

Net Promoter Score (NPS) in Nepal

Net Profit Margin Calculation in Nepal

What reports are generated through payroll processing?

Payroll processing generates various reports, including:

- Salary sheets: Detailed breakdown of salaries for all employees.

- Bank transfer reports: Lists of salary transfers for bank processing.

- Tax deduction reports: Summaries of tax withheld from employees.

- Social Security Fund contribution reports: Details of SSF contributions.

- Provident Fund reports: Summaries of PF deductions and contributions.

- Leave balance reports: Employee-wise leave accruals and balances.

- Overtime reports: Details of overtime hours worked and payments made.

- Loan and advance reports: Summaries of employee loans and advances.

- Payroll reconciliation reports: Comparisons of current and previous payroll periods.

- Annual tax summaries: Year-end tax reports for each employee.

- Cost center allocation reports: Payroll costs distributed across different departments or projects.

- Statutory compliance reports: Reports required for government filings.

How are bonuses and overtime calculated in payroll?

Bonus and overtime calculations in Nepal are governed by specific regulations:

Bonus Calculation:

- As per the Bonus Act 2030 (1974), employees are entitled to an annual bonus.

- The bonus is typically 10% of the annual profit, distributed among employees.

- The maximum bonus per employee is limited to 6 months’ salary.

- Festival bonuses (Dashain bonus) are often one month’s salary, paid before major festivals.

Overtime Calculation:

- According to the Labor Act 2074 (2017), overtime is paid at 1.5 times the regular hourly rate.

- Overtime is applicable for work beyond 8 hours a day or 48 hours a week.

- The maximum overtime allowed is 4 hours per day and 24 hours per week.

- Overtime calculation: (Basic salary ÷ 208 hours) × 1.5 × Overtime hours worked

These calculations are integrated into the payroll processing system to ensure accurate compensation.

What are the common challenges in payroll processing?

Common challenges in payroll processing in Nepal include:

- Regulatory compliance: Keeping up with frequent changes in labor laws and tax regulations.

- Data accuracy: Ensuring the correctness of employee information and time records.

- Tax complexities: Navigating the intricacies of Nepal’s tax system, especially for employees with multiple income sources.

- Timely processing: Meeting tight deadlines for salary disbursement and statutory filings.

- System integration: Aligning payroll systems with other HR and financial software.

- Data security: Protecting sensitive employee information from breaches.

- Managing leave and attendance: Accurately tracking and integrating leave and attendance data into payroll.

- Handling exceptions: Managing special cases like mid-month joiners, resignations, or salary revisions.

- Reconciliation: Ensuring payroll data matches with other financial records.

- Employee queries: Addressing payroll-related questions and concerns from employees efficiently.

Additional FAQs:

1. How are salary advances handled in payroll processing?

Salary advances in Nepal are typically handled as follows:

- The advance amount is recorded in the payroll system.

- It’s deducted from the employee’s next salary or spread across multiple pay periods.

- The deduction is reflected in the payslip and payroll reports.

- Tax implications, if any, are considered in the payroll calculations.

2. What is the role of banks in payroll processing?

Banks play a crucial role in payroll processing in Nepal:

- They facilitate bulk salary transfers from the employer’s account to employees’ accounts.

- Banks process these transfers based on the payroll data provided by employers.

- They may offer specialized corporate banking services for payroll management.

- Some banks provide integrated payroll solutions in partnership with payroll service providers.

3. How are part-time employees’ payrolls processed?

Part-time employee payroll processing in Nepal involves:

- Calculating wages based on hours worked or a fixed part-time salary.

- Pro-rating benefits and allowances as per company policy.

- Applying appropriate tax calculations, often using different tax slabs.

- Ensuring compliance with labor laws specific to part-time employment.

4. What are the penalties for payroll errors in Nepal?

Penalties for payroll errors in Nepal can include:

- Fines for late or incorrect tax deposits, as per the Income Tax Act.

- Penalties for non-compliance with labor laws, including incorrect wage calculations.

- Interest charges on unpaid or underpaid social security contributions.

- Potential legal action from employees for persistent payroll discrepancies.

5. How are employee benefits integrated into payroll processing?

Employee benefits integration in payroll processing involves:

- Including non-cash benefits in taxable income calculations.

- Managing deductions for employee-contributed benefits.

- Calculating employer contributions to benefits like health insurance.

- Ensuring proper tax treatment of various benefits as per Nepal’s tax laws.

- Reflecting benefit details in payslips and year-end tax statements.

6. What is the process for handling payroll disputes?

The process for handling payroll disputes in Nepal typically includes:

- Receiving and documenting the dispute from the employee.

- Investigating the issue by reviewing payroll records and calculations.

- Consulting relevant laws and company policies.

- Discussing findings with the employee and HR department.

- Making necessary corrections if an error is found.

- Updating payroll records and systems to prevent future occurrences.

- Providing a formal response to the employee.

- If unresolved, following the company’s grievance procedure or seeking mediation through labor authorities.

What is the payroll processing process?

Payroll processing involves several key steps. First, employee work hours and attendance are collected. Then, the salary is calculated, including any overtime, bonuses, or allowances. Afterward, necessary deductions, such as income tax, social security contributions, and other benefits, are calculated. The next step is generating payslips and reports, followed by the timely disbursement of salaries into employee accounts. Finally, the payroll processing company ensures that all tax returns and statutory filings are completed in compliance with local regulations.

Who is the largest payroll processor?

The largest payroll processor globally is ADP (Automatic Data Processing), which provides a comprehensive suite of payroll, tax, and compliance solutions. ADP serves millions of employees worldwide and offers tools that streamline payroll processing for businesses of all sizes.

What is a payroll processing company?

A payroll processing company is a service provider that handles the entire payroll function for businesses. This includes calculating and distributing employee salaries, managing tax withholdings, and ensuring compliance with legal and regulatory requirements. These companies also generate payslips, process bonuses, and handle deductions for taxes, provident funds, and insurance contributions.

What is SAP payroll processing?

SAP payroll processing refers to using SAP software to manage and automate payroll functions. SAP automates the entire payroll process, including wage calculations, deductions, tax filings, and payslip generation, ensuring compliance with local labor laws and tax regulations. The software is particularly useful for large organizations with complex payroll structures, as it integrates seamlessly with other business functions.

What is a payroll processing checklist?

A payroll processing checklist is a vital tool used to ensure all payroll tasks are completed correctly. Key steps include verifying employee attendance and hours worked, calculating gross salary, bonuses, and deductions, processing statutory contributions such as taxes and insurance, and ensuring that overtime and leave payments are addressed. The final steps include generating payslips and ensuring that salary disbursement is made on time while maintaining full compliance with relevant tax and reporting regulations.

How to calculate payroll?

To calculate payroll, start with the employee’s base salary and add any overtime, bonuses, or allowances they may be entitled to. Next, deduct mandatory contributions such as taxes, provident fund, and insurance. Additional deductions, like loans or advances, should also be subtracted. After all deductions, the final amount is the net pay, which is the employee’s take-home salary. Proper payroll calculation ensures accuracy in payments and compliance with tax obligations.