Are you wondering how to navigate the process of obtaining a Permanent Account Number (PAN) in Nepal? Look no further! This guide will walk you through everything you need to know about Online PAN registration in Nepal, from understanding what a PAN is to replacing your PAN card Nepal. Let’s dive in and demystify the process together.

What is a PAN Card in Nepal?

Have you ever wondered why some numbers seem to hold so much importance in the world of finance and taxation? In Nepal, one such crucial number is the PAN. But what exactly is it?

A PAN, or Permanent Account Number, is a unique 9-digit identification number issued by the Inland Revenue Department (IRD) of Nepal. Think of it as your financial fingerprint – it’s distinctive to you and plays a vital role in your fiscal identity. This number serves as a common reference point for all your tax-related activities and financial transactions.

Imagine trying to keep track of millions of taxpayers without a standardized system. Sounds like a nightmare, right? That’s where PAN comes in. It helps the government efficiently monitor tax compliance and prevent tax evasion. For you, it simplifies your interactions with various financial institutions and government bodies.

But PAN isn’t just about paying taxes. It’s your key to a world of financial opportunities. Need a loan? Want to open a bank account? Planning to start a business? Your PAN will likely be one of the first things you’re asked for. It’s like your financial passport, opening doors to various economic activities in Nepal.

Who needs to register for PAN Card?

Are you wondering if you need to join the PAN club? The answer might surprise you – it’s not just for a select few. In fact, a wide range of individuals and entities in Nepal are required to obtain a PAN. Let’s break it down:

- Individuals: If you’re earning an income in Nepal, whether through employment, business, or investments, you’ll need a PAN. This includes salaried employees, freelancers, and even those earning rental income.

- Businesses: From small corner shops to large corporations, all businesses operating in Nepal must have a PAN. This includes sole proprietorships, partnerships, and companies.

- Non-Profit Organizations: Even if you’re not in it for the profit, you still need a PAN. All NGOs and charitable organizations are required to register.

- Government Offices: Yes, even government entities need a PAN for their financial transactions.

- Educational Institutions: Schools, colleges, and universities fall under this category.

- Foreign Investors: If you’re investing in Nepal from abroad, you’ll need a PAN to comply with local tax laws.

- Anyone making high-value purchases: Planning to buy land or a vehicle? You’ll need a PAN for these transactions.

Remember, if you’re involved in any kind of financial transaction or economic activity in Nepal, it’s better to be safe than sorry. When in doubt, get a PAN. It’s not just about following the law – it’s about unlocking your full economic potential in Nepal.

Where to apply for PAN Card Registration in Nepal?

Now that you know you need a PAN, you’re probably wondering, “Where do I go to get one?” Don’t worry, we’ve got you covered. The process is simpler than you might think, and there are several options available to suit your convenience.

1. Inland Revenue Offices

The most traditional route is to visit your nearest Inland Revenue Office (IRO). These are government offices specifically tasked with handling tax-related matters, including PAN registration. Here’s what you need to know:

- There are IROs located in major cities and districts across Nepal.

- You can find a complete list of IRO locations on the Inland Revenue Department’s official website.

- This option is great if you prefer face-to-face interactions or need guidance on filling out forms.

2. Online Application

In this digital age, Nepal has embraced technology to make PAN registration more accessible. You can now apply online through the Inland Revenue Department’s official website. Here’s why this might be a good option for you:

- It’s convenient – apply from the comfort of your home or office.

- Available 24/7, so you can apply whenever it suits your schedule.

- Reduces paperwork and saves time.

3. Tax Consultants and Accounting Firms

If you’re feeling overwhelmed by the process or simply don’t have the time to handle it yourself, consider reaching out to professional help. Many tax consultants and accounting firms in Nepal offer PAN registration services. The benefits include:

- Expert guidance throughout the process.

- They can handle the paperwork and follow-ups on your behalf.

- Useful if you’re registering a business PAN, as they can advise on other tax-related matters as well.

4. Banks and Financial Institutions

Some banks in Nepal have partnered with the IRD to offer PAN registration services. If you’re already a customer, this could be a convenient option:

- You can often combine this with other banking services.

- Familiar environment if you’re already comfortable with your bank.

Remember, regardless of where you choose to apply, the core requirements remain the same. The key is to pick the option that best suits your needs and comfort level. Whether you’re tech-savvy and prefer online applications, or you feel more secure with in-person interactions, there’s a PAN registration method that’s right for you.

Relevant Articles:

- Tax Liability Dispute Process in Nepal

- Process of Filing for Excise Duty in Nepal

- Import Tax Procedure in Nepal

What documents are needed for PAN registration?

Preparing for your PAN registration? Great! Let’s make sure you have all your ducks in a row. The documents you’ll need can vary slightly depending on whether you’re an individual, a business, or fall into another category. But don’t worry, we’ll break it down for you.

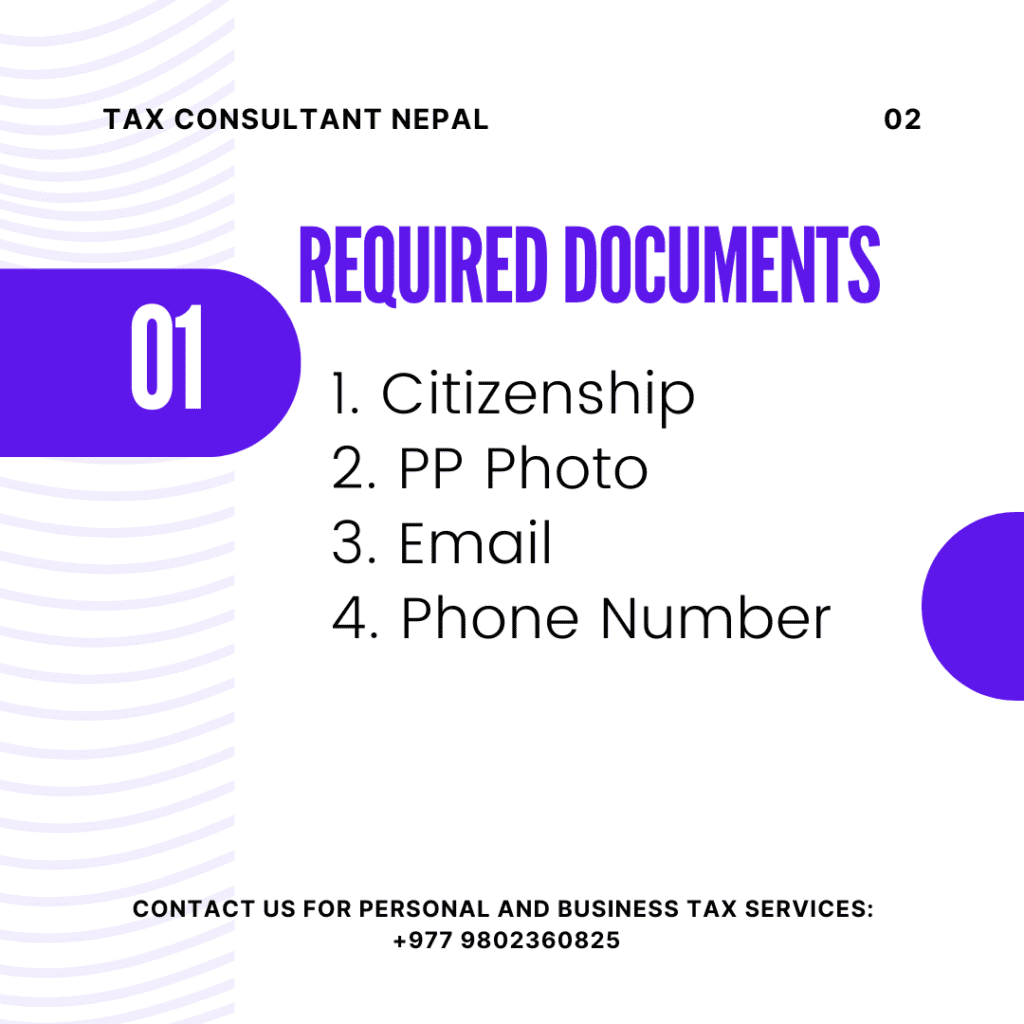

For Individuals:

- Citizenship Certificate: This is your primary proof of identity and nationality. Make sure you have a clear copy of both sides.

- Recent Passport-sized Photograph: Smile! You’ll need a couple of these. Make sure they meet the standard specifications.

- Proof of Address: This could be a recent utility bill, rental agreement, or any government-issued document that shows your current address.

- Income Proof: If you’re employed, you’ll need a letter from your employer. For self-employed individuals, business registration documents will suffice.

- Taxpayer Registration Form: This is available at IRO offices or can be downloaded from their website. Fill it out accurately!

For Businesses:

- Company Registration Certificate: This proves your business is legally established in Nepal.

- Memorandum and Articles of Association: These documents outline your company’s purpose and internal rules.

- PAN documents of Directors/Partners: Yes, the individuals running the business need their personal PANs too.

- Proof of Business Address: A rental agreement or property ownership document for your business premises.

- Bank Account Details: You’ll need to provide information about your business bank account.

- Business PAN Registration Form: Similar to the individual form, but tailored for businesses.

Additional Documents (if applicable):

- For foreign nationals: Valid visa and work permit.

- For minors: Birth certificate and PAN details of parents/guardians.

- For NGOs: Registration certificate from the Social Welfare Council.

Remember, always carry original documents for verification, along with photocopies. The officials may need to cross-check the originals with the copies you submit.

Pro tip: Organize your documents in advance and keep them in a folder. This not only makes the process smoother for you but also shows the officials that you’re well-prepared and serious about your application.

By ensuring you have all these documents ready, you’re setting yourself up for a smooth and hassle-free PAN registration process. It’s always better to be over-prepared than to find yourself missing a crucial document at the last minute!

How long does PAN registration take?

Wondering how long you’ll have to wait before you can start using your shiny new PAN? Let’s break down the timeline for you.

The good news is that PAN registration in Nepal is generally a quick process. However, the exact duration can vary depending on a few factors. Here’s what you can expect:

- Online Applications: If you’ve applied online, you’re in luck! This is usually the fastest route. In most cases, you can receive your PAN within 1-3 working days after submission of all required documents.

- In-Person Applications: If you’ve applied at an Inland Revenue Office, the process might take a bit longer. Typically, you can expect to receive your PAN within 3-5 working days.

- Business PAN: For companies and other entities, the process might take slightly longer due to additional verifications. Usually, it takes about 5-7 working days.

- Peak Seasons: During busy periods, like the end of the fiscal year, processing times might be extended by a day or two.

- Incomplete Applications: If your application is incomplete or there are discrepancies in your documents, it could delay the process. Always double-check your application!

Remember, these are general timelines. In some cases, you might receive your PAN even faster. The key is to ensure that you provide all the necessary documents and information correctly.

Pro tip: If you need your PAN urgently, mention this when submitting your application. Some offices may offer expedited processing for genuine urgent cases.

While waiting for your PAN, you can check the status of your application online through the IRD website or by contacting the office where you applied. Once your PAN is ready, you’ll be notified via SMS or email, depending on the contact information you provided.

In the grand scheme of things, the wait for your PAN is relatively short. Before you know it, you’ll have this crucial financial identifier in your hands, ready to unlock a world of financial opportunities in Nepal!

Is there a fee for PAN registration?

When it comes to finances, we all want to know about the costs involved, right? So, let’s talk about the fees associated with PAN registration in Nepal.

Here’s the great news: PAN registration in Nepal is absolutely free! Yes, you read that right. The Nepalese government does not charge any fee for issuing a PAN. This policy is designed to encourage widespread registration and promote financial inclusion.

But wait, there’s more to consider:

- Online Registration: If you’re applying online, there are no hidden charges. It’s completely free from start to finish.

- In-Person Application: Even if you choose to apply at an Inland Revenue Office, there’s no fee for the service.

- Document Preparation: While the registration itself is free, you might incur some minor costs in preparing your documents. This could include expenses for photocopying, photographs, or notarization (if required).

- Professional Services: If you choose to use the services of a tax consultant or an accounting firm to help with your PAN registration, they may charge a fee for their assistance. These fees can vary, so it’s best to inquire beforehand.

- Replacement or Correction: In case you need to replace a lost PAN card or correct information on an existing one, there might be a nominal fee. However, the initial registration remains free.

- Business PAN: Even for businesses, the basic PAN registration is free. However, there might be associated costs for other business registrations that often go hand-in-hand with getting a PAN.

It’s important to note that while the registration is free, a PAN comes with responsibilities. Once you have a PAN, you’re in the tax system, which means you’ll need to file tax returns as applicable to your situation.

Pro tip: Be wary of anyone asking for a fee for basic PAN registration. If someone claims there’s a charge, double-check with the official Inland Revenue Department website or office.

The fact that PAN registration is free is a testament to the government’s commitment to making it accessible to all. It’s an investment in the country’s financial infrastructure, and you’re an important part of it. So go ahead, get your free PAN, and take the first step towards financial empowerment in Nepal!

Can foreigners apply for PAN in Nepal?

Are you a foreigner in Nepal wondering if you can get a PAN? The short answer is yes, you can! Nepal’s tax system is designed to be inclusive, recognizing that foreigners often play significant roles in the country’s economy. Let’s dive into the details of how foreigners can apply for a PAN in Nepal.

Who is eligible?

- Foreign Investors: If you’re investing in Nepal-based businesses or projects.

- Expatriate Workers: Employed by companies in Nepal.

- Freelancers: Working for Nepalese clients while based in Nepal.

- Business Owners: Running a company or partnership in Nepal.

- Property Owners: If you own property in Nepal.

What you need to know:

- Valid Visa: You must have a valid visa that allows you to work or conduct business in Nepal.

- Work Permit: For employed individuals, a work permit is usually required.

- Document Requirements: Along with the standard PAN application form, you’ll need to provide:

- A copy of your passport

- Your valid visa

- Work permit (if applicable)

- Proof of address in Nepal (rental agreement or company letter)

- Local Sponsor: In some cases, you might need a local sponsor or your employing company to vouch for you.

- Application Process: The process is similar to that for Nepalese citizens. You can apply online or visit an Inland Revenue Office.

- Duration: PAN for foreigners is typically linked to the duration of their visa or work permit.

- Renewal: You may need to renew your PAN if you extend your stay in Nepal.

Benefits of having a PAN as a foreigner:

- Easier financial transactions within Nepal

- Ability to open local bank accounts

- Compliance with tax regulations

- Smoother business operations if you’re an entrepreneur

Remember, as a PAN holder, you’ll be subject to Nepalese tax laws. It’s advisable to consult with a local tax expert to understand your obligations fully.

Getting a PAN as a foreigner in Nepal is not just possible, it’s often necessary if you’re planning to stay for an extended period or engage in economic activities. It’s Nepal’s way of saying, “Welcome to our financial system!” So, if you’re a foreigner making Nepal your home, even temporarily, consider getting your PAN. It’s your ticket to smoother financial sailing in this beautiful Himalayan nation!

Is online PAN registration available in Nepal?

In today’s digital age, you might be wondering if you can skip the queues and paperwork and register for your PAN online. Well, I’ve got good news for you – yes, online PAN registration is indeed available in Nepal!

The Inland Revenue Department (IRD) of Nepal has embraced technology to make the PAN registration process more accessible and convenient. Here’s what you need to know about online PAN registration:

- Official Platform: The online registration is done through the IRD’s official website. It’s a secure platform designed to protect your personal information.

- User-Friendly Interface: The online system is designed to be intuitive, guiding you through each step of the process.

- 24/7 Availability: Unlike physical offices, the online platform is available round the clock. You can apply at your convenience, whether it’s early morning or late at night.

- Document Upload: You’ll need to scan and upload the required documents. Make sure they’re clear and legible.

- Digital Signature: The system uses a digital signature process, eliminating the need for physical signatures.

- Instant Acknowledgment: Once you submit your application, you’ll receive an instant acknowledgment with a reference number.

- Status Tracking: You can track the status of your application online using your reference number.

- Faster Processing: Generally, online applications are processed faster than in-person applications.

- Support System: If you face any issues, there’s usually an online help desk or customer support available.

- Eco-Friendly: By reducing paper usage, online registration is a more environmentally friendly option.

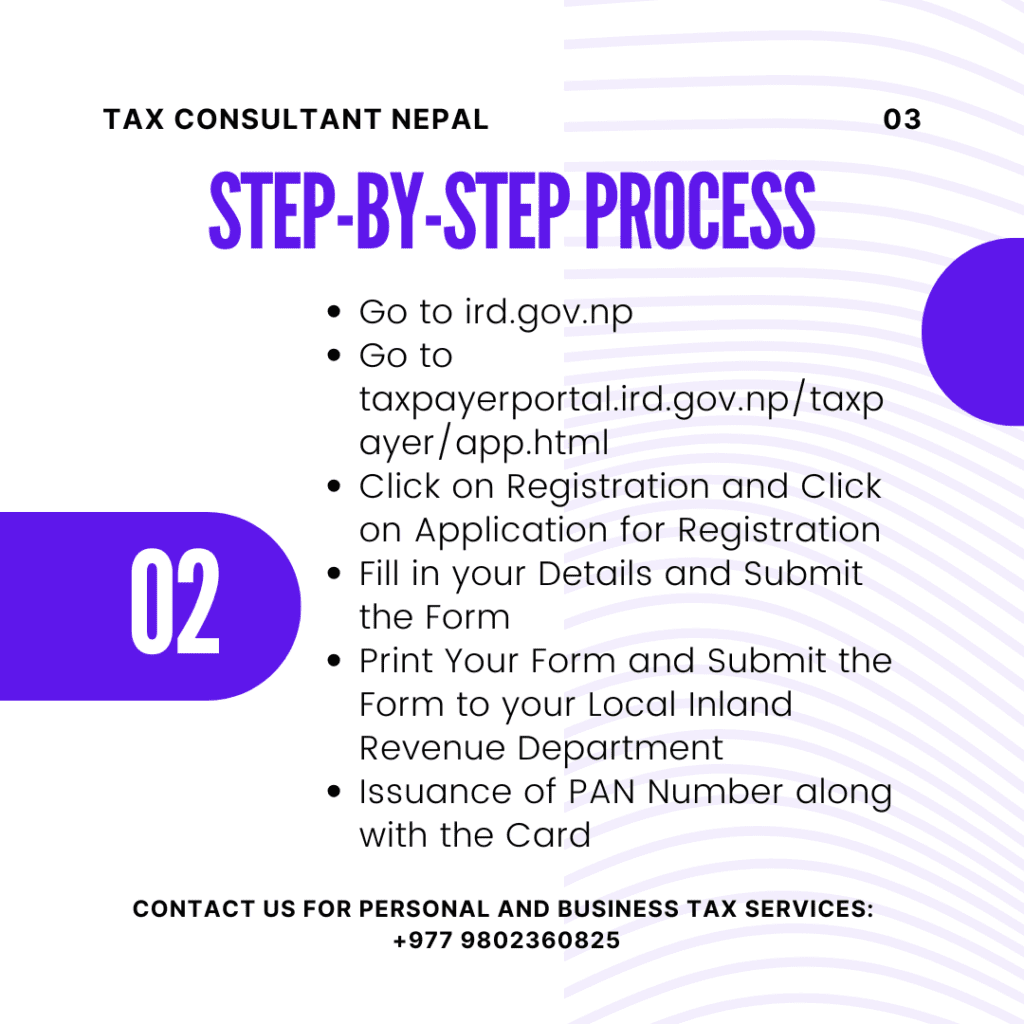

To use the online system:

- Visit the official IRD website

- Look for the ‘PAN Registration’ or similar section

- Create an account if required

- Fill in the online application form

- Upload the necessary documents

- Review and submit your application

- Note down your application reference number

Remember, while online registration is convenient, it’s crucial to ensure that all the information you provide is accurate. Double-check everything before hitting that submit button!

Online PAN registration in Nepal is a testament to the country’s efforts to modernize its tax system and make it more accessible to everyone. Whether you’re in Kathmandu or Pokhara, in your office or at home, you’re just a few clicks away from starting your PAN registration process. It’s fast, it’s convenient, and it’s the future of tax administration in Nepal. So why wait? If you need a PAN, consider giving the online registration a try!

Education consultancy registration in Nepal

Manpower company registration in Nepal

How to verify a PAN number?

Have you ever received a PAN number and wondered, “Is this really valid?” Or maybe you’re a business owner who needs to verify a customer’s PAN. Whatever your reason, knowing how to verify a PAN number in Nepal is an essential skill in today’s financial landscape. Let’s walk through the process together.

How can I register my PAN number in Nepal?

1. Visit the Inland Revenue Department (IRD) website: ird.gov.np.

2. Click on “Taxpayer Portal” → “Registration (PAN, VAT, EXCISE)”.

3. Select “Personal PAN” or “Business PAN” and fill out the form.

4. Upload required documents (citizenship, company documents for business PAN).

5. Submit the application and visit the tax office for verification.

6. Receive your PAN card after approval.

How can I check my PAN Card registration?

1. Visit ird.gov.np and go to the “Taxpayer Portal”.

2. Click on “Search Taxpayer Details”.

3. Enter your PAN number or other details.

4. View your PAN registration status online.

How to register a PAN card in Nepal?

1. Apply online via the IRD website.

2. Submit required documents (citizenship for personal PAN, company registration for business PAN).

3. Visit the tax office for verification.

4. Collect your PAN card upon approval.

What is the age limit for a PAN card in Nepal?

There is no specific minimum age requirement for PAN registration in Nepal. However, it is mandatory for individuals who earn taxable income, including salaried employees and business owners.

Why is a PAN number required?

A PAN number is essential for tax filing and financial transactions in Nepal. It is mandatory for salaried individuals, businesses, and those involved in financial dealings with the government. PAN helps track tax compliance, prevents tax evasion, and ensures transparency in financial transactions.

How to pay PAN tax in Nepal?

1. Log in to the IRD e-Payment portal.

2. Generate a tax payment voucher (eSewa, Khalti, ConnectIPS).

3. Pay online or at designated banks.

4. Keep the payment receipt for records.