International Non-Governmental Organizations (INGOs) play a crucial role in Nepal’s development and humanitarian efforts. This comprehensive guide explores the process of INGO registration in Nepal, including legal requirements, procedures, and essential information for foreign organizations seeking to establish their presence in the country.

Understanding INGOs in Nepal

What is an INGO in Nepal?

An International Non-Governmental Organization (INGO) in Nepal is a foreign-based non-profit entity that operates in the country to support various development, humanitarian, and social welfare initiatives. INGOs are regulated by the Social Welfare Council (SWC) and must comply with Nepali laws and regulations. These organizations typically focus on areas such as poverty alleviation, education, healthcare, environmental conservation, and disaster relief. INGOs in Nepal work in partnership with local NGOs and government agencies to implement projects and programs that benefit Nepali communities.

Laws Governing INGOs in Nepal

INGOs in Nepal are primarily governed by the Social Welfare Act, 2049 (1992) and the Association Registration Act, 2034 (1977). These laws provide the legal framework for the registration, operation, and regulation of INGOs in the country. The Social Welfare Council (SWC) is the primary regulatory body overseeing INGO activities in Nepal. Additionally, INGOs must adhere to the Development Cooperation Policy, 2019, which outlines guidelines for foreign aid and development assistance. The Foreign Aid Policy, 2002 also plays a role in regulating INGO operations, ensuring that their activities align with national development priorities and goals.

INGO Registration Process in Nepal

How to Register an INGO in Nepal

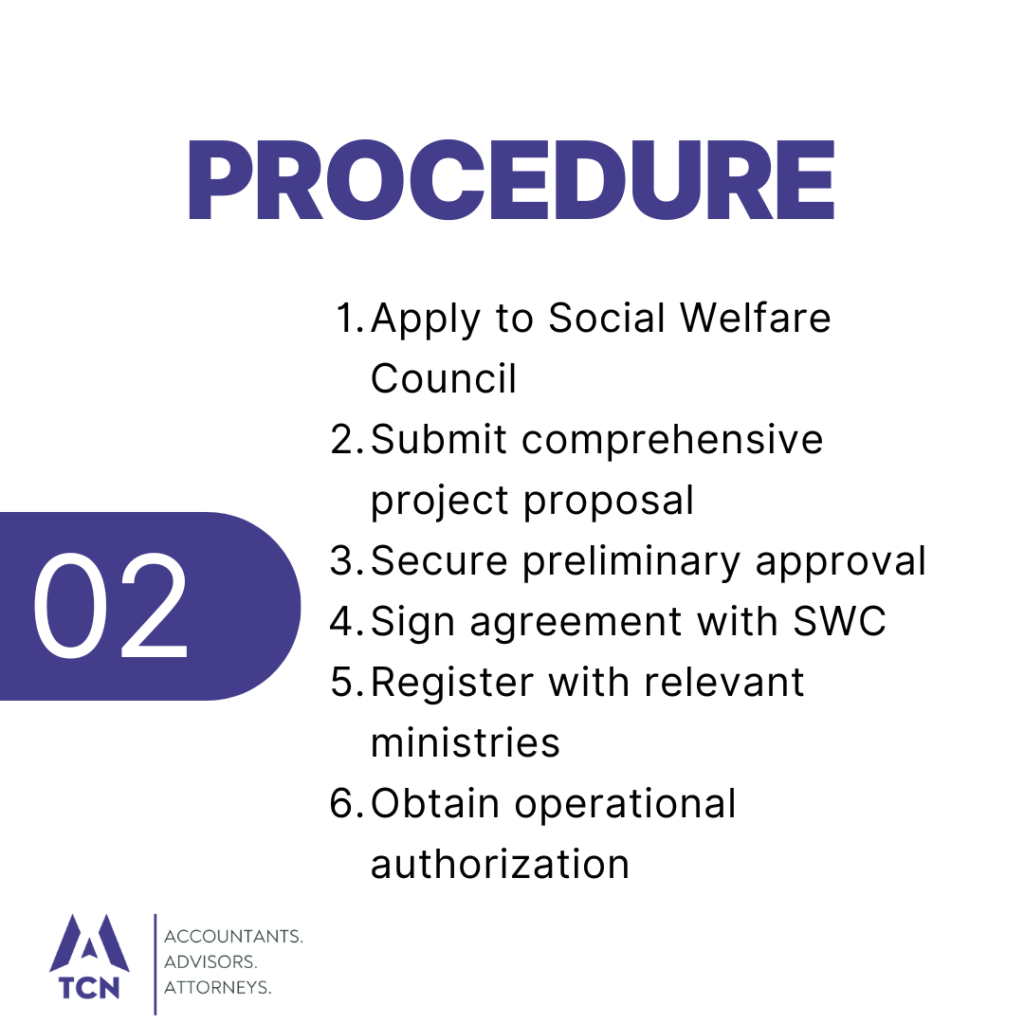

Registering an INGO in Nepal involves a multi-step process that requires careful preparation and adherence to legal requirements. Here’s a step-by-step guide to INGO registration:

- Prepare required documents: Gather all necessary documents, including the organization’s constitution, registration certificate from the home country, and project proposals.

- Submit application to SWC: File an application with the Social Welfare Council, including all required documents and forms.

- Obtain recommendation: Secure a recommendation from the relevant line ministry based on the INGO’s proposed activities.

- SWC review: The Social Welfare Council will review the application and may request additional information or clarifications.

- Approval and agreement signing: Upon approval, sign a general agreement with the SWC outlining the terms of operation in Nepal.

- Project agreement: Develop and sign specific project agreements with relevant government agencies for each proposed project.

- Registration completion: Receive the official registration certificate from the SWC, allowing the INGO to begin operations in Nepal.

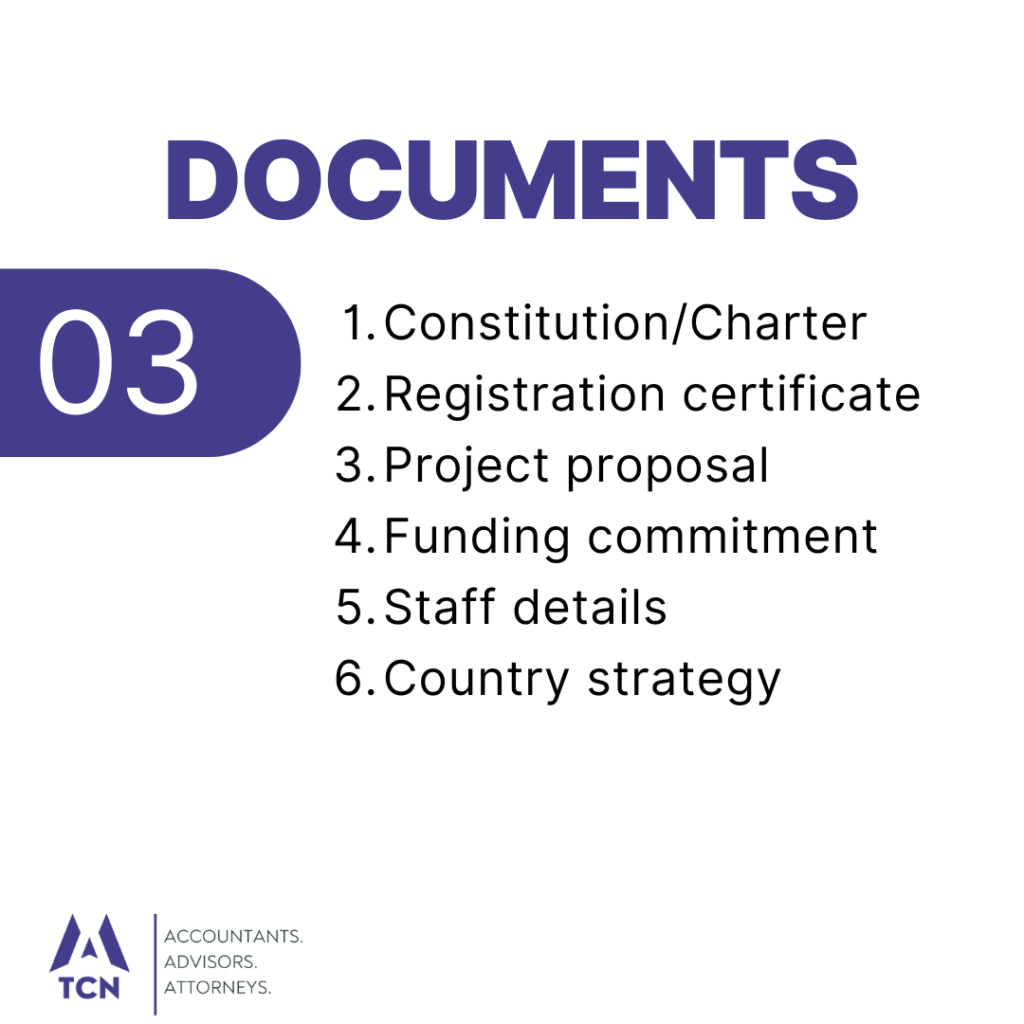

Required Documents for INGO Registration

To register an INGO in Nepal, the following documents are typically required:

- Application form (available from the SWC)

- Copy of the organization’s constitution or bylaws

- Registration certificate from the home country

- Latest audited financial report

- Detailed project proposal(s)

- Commitment letter for financial and technical support

- Recommendation letter from the relevant line ministry

- CV and passport copies of key personnel

- Letter of intent from local partner organizations (if applicable)

- Tax clearance certificate (if previously operating in Nepal)

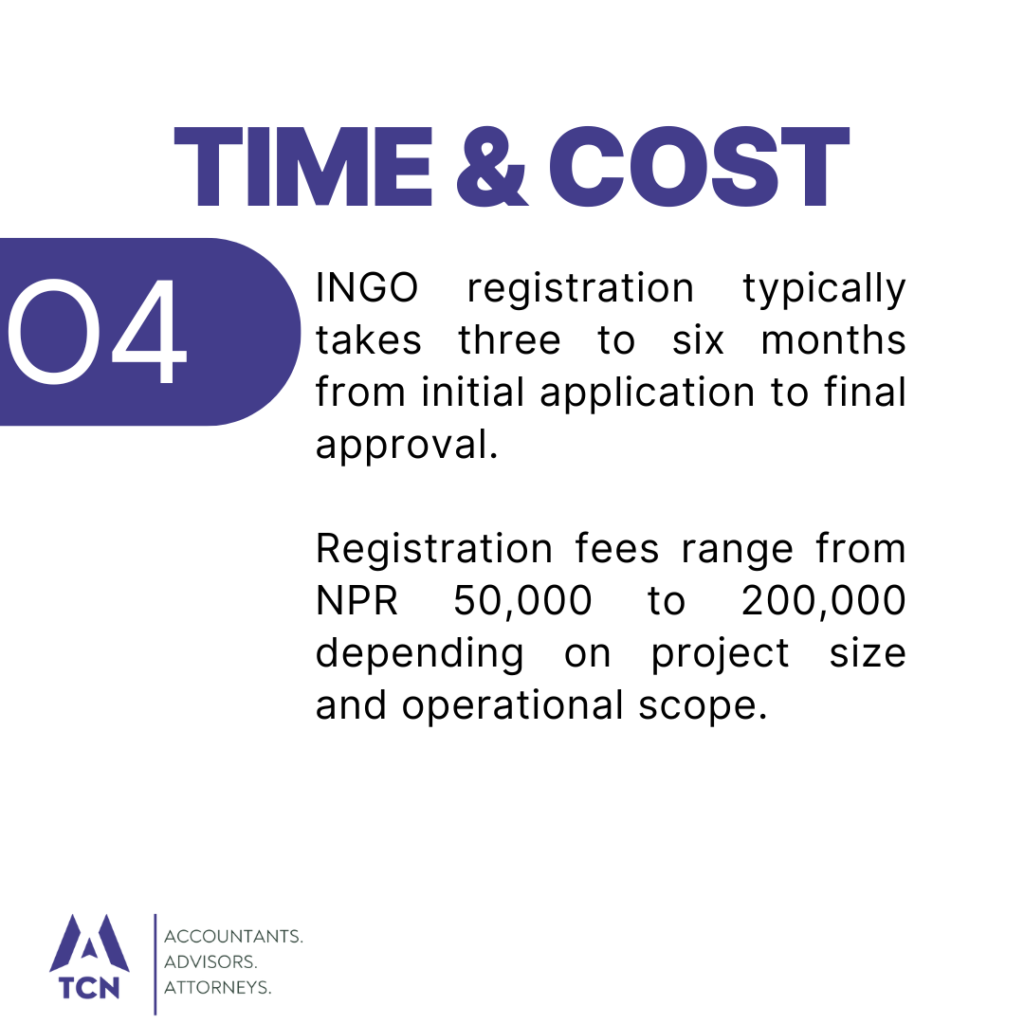

Timeline for INGO Registration

The INGO registration process in Nepal can take several months to complete, typically ranging from 3 to 6 months. However, the actual duration may vary depending on factors such as the completeness of the application, the complexity of proposed projects, and the workload of the Social Welfare Council. It’s advisable to start the registration process well in advance of planned activities to allow for any potential delays or additional requirements.

Cost of Registering an INGO in Nepal

The cost of registering an INGO in Nepal includes both official fees and associated expenses. The official registration fee is relatively modest, typically around NPR 15,000 to NPR 20,000 (approximately USD 125 to USD 165). However, additional costs may include legal fees, document translation, notarization, and other administrative expenses. INGOs should budget for these additional costs, which can vary depending on the complexity of the registration process and the need for professional assistance.

Key Considerations for INGO Registration

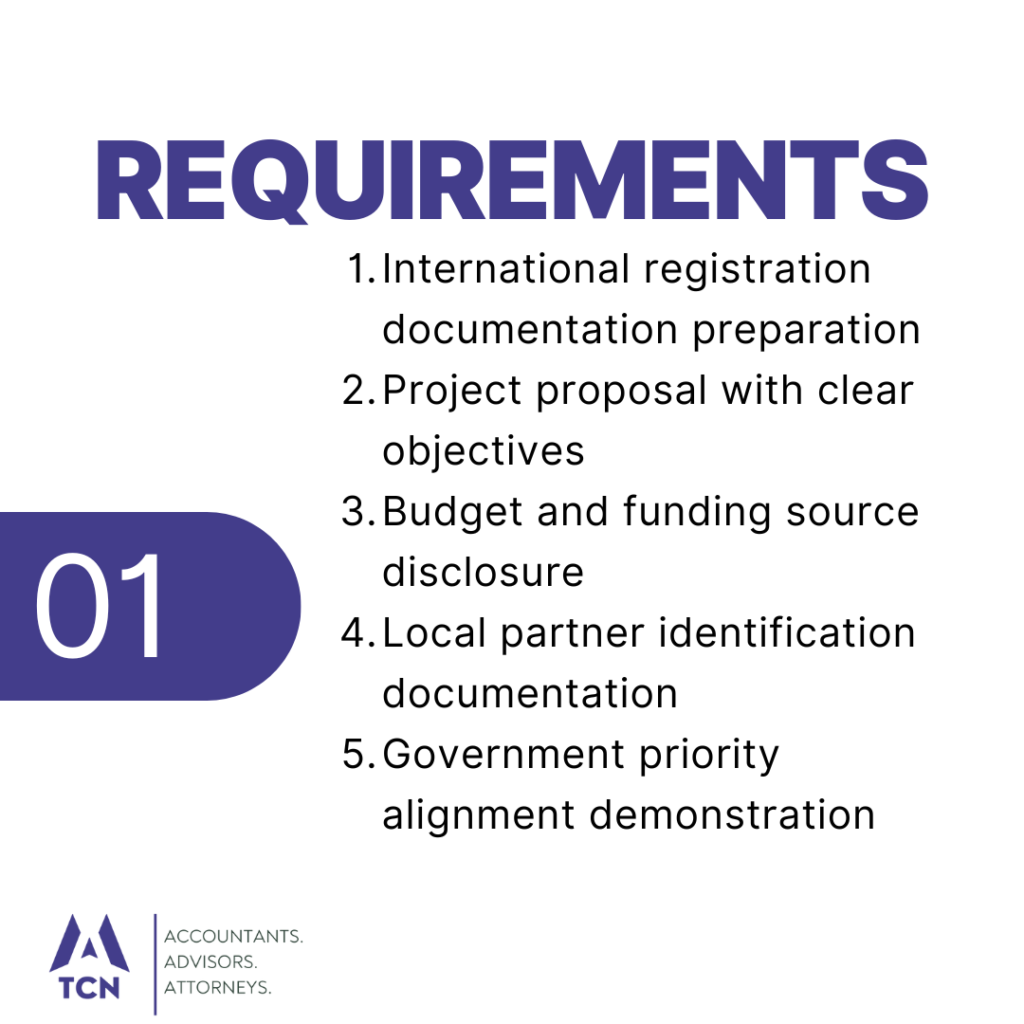

Requirements for INGO Registration

To successfully register an INGO in Nepal, organizations must meet several key requirements:

- Align with Nepal’s development priorities

- Demonstrate financial stability and sustainability

- Have a clear mission and objectives

- Provide evidence of successful projects in other countries

- Commit to working with local partners and building local capacity

- Agree to comply with Nepali laws and regulations

- Maintain transparency in financial and operational matters

- Obtain necessary approvals from relevant government agencies

- Agree to regular monitoring and evaluation by the SWC

- Contribute to Nepal’s socio-economic development goals

Where to Register an INGO in Nepal

INGOs must register with the Social Welfare Council (SWC), which is the primary regulatory body for INGOs in Nepal. The SWC is located in Kathmandu, and all registration processes are centralized through this office. While initial inquiries and document submissions can often be made electronically, in-person visits to the SWC office may be required during the registration process.

Regulatory Authority for INGOs in Nepal

The Social Welfare Council (SWC) is the primary regulatory authority for INGOs in Nepal. Established under the Social Welfare Act, 2049 (1992), the SWC is responsible for overseeing, coordinating, and facilitating the work of both national and international non-governmental organizations. The SWC works in collaboration with other government agencies, including relevant line ministries, to ensure that INGO activities align with national development priorities and comply with Nepali laws and regulations.

Operating as a Foreign INGO in Nepal

Foreign INGOs can operate in Nepal after successfully completing the registration process with the Social Welfare Council. However, they must adhere to specific guidelines and regulations:

- Obtain work permits for expatriate staff

- Open a local bank account for fund transfers

- Submit regular progress reports to the SWC

- Undergo annual audits by approved Nepali auditors

- Renew registration every 1-5 years, depending on the agreement

- Coordinate activities with relevant government agencies

- Prioritize capacity building of local partners and staff

- Ensure transparency in financial transactions and project implementation

- Comply with local labor laws and tax regulations

- Respect Nepali culture and traditions in all operations

Local Partners for INGOs in Nepal

While not strictly mandatory, INGOs are strongly encouraged to work with local partners in Nepal. Partnering with local NGOs or community-based organizations offers several benefits:

- Enhanced understanding of local context and needs

- Improved project implementation and sustainability

- Capacity building of local organizations

- Better acceptance by local communities

- Compliance with government preferences for localization

- Easier navigation of local bureaucratic processes

- Access to local expertise and resources

- Promotion of long-term development impact

- Alignment with Nepal’s development cooperation policies

- Facilitation of knowledge and skill transfer

Services Offered by Tax Consultant Nepal for INGO Registration

1. INGO Registration Assistance

Tax Consultant Nepal provides comprehensive support for INGO registration, guiding organizations through the entire process. Our experts assist in document preparation, application submission, and liaison with the Social Welfare Council and relevant ministries. We ensure all legal requirements are met and help streamline the registration process for efficient approval.

2. Legal Compliance Advisory

Our team offers expert advice on legal compliance for INGOs operating in Nepal. We provide up-to-date information on relevant laws, regulations, and policies affecting INGO operations. This service includes guidance on labor laws, tax obligations, and reporting requirements to ensure INGOs maintain full compliance with Nepali legislation.

3. Financial Management and Reporting

Tax Consultant Nepal assists INGOs in establishing robust financial management systems tailored to Nepali regulatory requirements. We offer services in financial reporting, budgeting, and audit preparation, ensuring transparency and accountability in financial operations. Our expertise helps INGOs meet the stringent financial reporting standards set by the Social Welfare Council.

4. Project Agreement Facilitation

We facilitate the development and negotiation of project agreements between INGOs and relevant government agencies. Our team helps draft agreements that align with both INGO objectives and Nepal’s development priorities, ensuring smooth approval processes and effective project implementation.

5. Work Permit and Visa Services

For INGOs bringing international staff to Nepal, we provide comprehensive work permit and visa services. This includes assistance with application processes, documentation, and liaison with immigration authorities to ensure compliance with Nepal’s foreign employment regulations.

6. Local Partner Identification

Tax Consultant Nepal helps INGOs identify and vet potential local partners. We leverage our extensive network to connect INGOs with reputable local NGOs and community-based organizations, facilitating effective partnerships that enhance project outcomes and local capacity building.

7. Tax Planning and Compliance

Our tax experts provide specialized services in tax planning and compliance for INGOs. We offer guidance on tax exemptions, VAT refunds, and other tax-related matters specific to non-profit organizations operating in Nepal, ensuring optimal financial management and regulatory compliance.

8. Capacity Building and Training

We offer tailored training programs for INGO staff and local partners on various aspects of operations in Nepal. This includes workshops on legal compliance, financial management, project implementation, and cultural sensitivity, enhancing the effectiveness and sustainability of INGO activities.

9. Monitoring and Evaluation Support

Tax Consultant Nepal assists INGOs in developing and implementing robust monitoring and evaluation systems. We help design frameworks that meet both INGO internal requirements and SWC reporting standards, ensuring effective tracking of project impacts and outcomes.

10. Renewal and Reporting Services

We provide ongoing support for INGO registration renewals and periodic reporting to the Social Welfare Council. Our team ensures timely submission of required documents and reports, maintaining good standing with regulatory authorities and facilitating uninterrupted INGO operations in Nepal.

In conclusion, INGO registration in Nepal involves a complex process requiring careful navigation of legal and regulatory requirements. Tax Consultant Nepal offers comprehensive services to support INGOs throughout their establishment and operation in the country, ensuring compliance, efficiency, and effectiveness in their vital development and humanitarian work.