Understanding how to apply for a Tax Identification Number (TIN) is crucial for individuals and businesses operating in Nepal. This guide will walk you through the process, helping you understand what a TIN is, who needs one, and how to obtain it. Let’s dive into the details of TIN application in Nepal.

What is a TIN in Nepal?

A Tax Identification Number (TIN) in Nepal is a unique identifier assigned to taxpayers by the Inland Revenue Department (IRD). This number is essential for tax-related transactions and helps the government track your tax obligations. Think of it as your fiscal fingerprint – it’s unique to you and plays a vital role in your financial interactions with the Nepalese tax system.

Who needs to apply for a TIN?

In Nepal, several groups are required to obtain a TIN:

- Individuals earning taxable income

- Registered businesses and companies

- Non-profit organizations

- Government agencies and institutions

- Foreign investors operating in Nepal

- Importers and exporters

- Professionals such as doctors, lawyers, and consultants

If you fall into any of these categories, it’s crucial to apply for a TIN to ensure compliance with Nepalese tax laws.

Where to apply for Tax Identification Number (TIN)?

Obtaining a TIN in Nepal is a straightforward process. You can apply at any of the following locations:

- Inland Revenue Offices (IROs) across Nepal

- Large Taxpayers Office (LTO) in Kathmandu

- Medium Level Taxpayers Office (MLTO) in Kathmandu

- Taxpayer Service Offices (TSOs) in various districts

These offices are equipped to handle TIN applications and provide assistance throughout the process. It’s advisable to choose the office nearest to your location or the one that aligns with your taxpayer category.

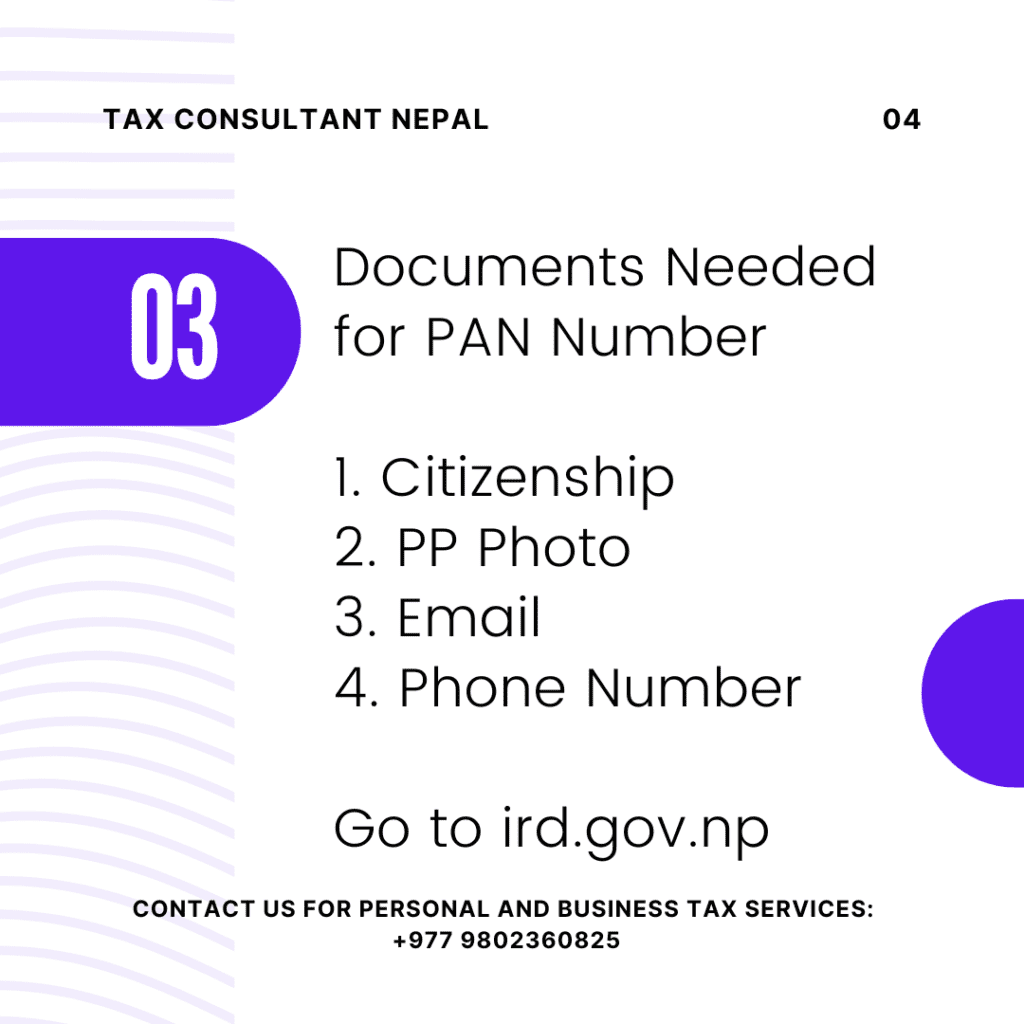

What documents are needed for Tax Identification Number (TIN)?

When applying for a TIN in Nepal, you’ll need to prepare the following documents:

- Completed TIN application form

- Citizenship certificate or passport (for individuals)

- Company registration certificate (for businesses)

- PAN card (if applicable)

- Photographs of the applicant or company representatives

- Proof of address (utility bill or rental agreement)

- Business plan or feasibility study (for new businesses)

Ensure all documents are current and authentic to avoid delays in the application process. It’s always a good idea to bring original documents along with photocopies for verification.

How long does TIN Tax Identification application process take?

The TIN application process in Nepal is relatively quick, typically taking 1-3 business days. However, this timeline can vary depending on factors such as:

- Completeness of your application

- Volume of applications being processed

- Complexity of your tax situation

- Verification requirements for your documents

To expedite the process, double-check your application for errors and provide all required documents upfront. If there are any issues with your application, the IRD will contact you for additional information, which could extend the processing time.

Relevant Articles:

- External Audit Process in Nepal

- Process for Tax Audit in Nepal

- Step-by-Step Guide to Registering for VAT in Nepal

- Company registration in Nepal

Is there a fee for TIN Tax Identification Number ?

Good news for taxpayers in Nepal – there is no fee for TIN application. The Nepalese government provides this service free of charge to encourage tax compliance and make it easier for individuals and businesses to enter the formal economy. However, be aware that while the application itself is free, you may incur minor costs for document preparation, such as photocopying or notarization fees.

Can foreigners apply for TIN Tax Identification Number ?

Yes, foreigners can and often must apply for a TIN in Nepal under certain circumstances:

- If they are working in Nepal with a valid work permit

- When investing in Nepalese businesses or real estate

- If operating a business in Nepal

- When earning income from Nepalese sources

The process for foreigners is similar to that for Nepalese citizens, with a few additional requirements:

- Valid passport and visa

- Work permit (if applicable)

- Recommendation letter from the employing company or investment partners

Foreigners should contact the nearest IRO or seek assistance from a tax consultant to ensure they meet all legal requirements for obtaining a TIN in Nepal.

Is online TIN Tax Identification Number application available in Nepal?

Currently, Nepal does not offer a fully online TIN application process. However, the IRD has made efforts to digitize parts of the system:

- You can download the TIN application form from the IRD website

- Some preliminary information can be submitted online

- Certain tax-related services are available through the IRD’s e-portal

While you still need to visit an IRO to complete the application, these digital initiatives have streamlined the process. Keep an eye on the IRD’s official website for updates, as there are ongoing efforts to introduce a comprehensive online application system in the future.

How to verify a TIN number?

Verifying a TIN number in Nepal is crucial for business transactions and tax compliance. Here’s how you can do it:

- Visit the IRD’s official website (www.ird.gov.np)

- Look for the “PAN/VAT Search” or “Taxpayer Verification” section

- Enter the TIN number you wish to verify

- Provide any additional required information (e.g., company name)

- Complete the CAPTCHA or security check

- Click “Search” or “Verify”

The system will display basic information about the TIN holder if it’s valid. This verification process helps prevent fraud and ensures you’re dealing with legitimate taxpayers or businesses.

What’s the difference between TIN and PAN?

In Nepal, TIN and PAN are often used interchangeably, but there are subtle differences:

- TIN (Tax Identification Number) is a broader term used globally

- PAN (Permanent Account Number) is specific to Nepal and some other South Asian countries

Functionally, they serve the same purpose – identifying taxpayers. In Nepal:

- PAN is the term commonly used for individual taxpayers

- TIN is more frequently associated with businesses

Both numbers are issued by the IRD and are used for tax-related purposes. When applying, you’ll receive a number that serves as both your TIN and PAN. For all practical purposes in Nepal, you can consider TIN and PAN as equivalent.

The TIN Application Process in Nepal

Applying for a TIN in Nepal involves several steps. Here’s a detailed guide to help you navigate the process smoothly:

- Determine your eligibility: Assess whether you need a TIN based on your income, business activities, or professional status.

- Gather required documents: Collect all necessary paperwork, including identification, business registration (if applicable), and proof of address.

- Obtain the application form: Download the TIN application form from the IRD website or collect it from your nearest IRO.

- Fill out the application: Complete the form accurately, providing all required information. Double-check for errors to avoid delays.

- Submit your application: Visit the appropriate IRO or TSO with your completed form and supporting documents.

- Verification process: An IRD official will review your application and may ask for additional information or clarification if needed.

- Receive your TIN: If your application is approved, you’ll be issued a TIN certificate. This usually happens within 1-3 business days.

Throughout this process, maintain open communication with the IRD officials. They can provide guidance and help resolve any issues that may arise. Remember, accuracy and completeness in your application are key to a swift and successful TIN registration.

How to get a VAT number in Nepal?

1. Register at the Inland Revenue Office (IRO) under the Ministry of Finance.

2. Submit required documents: PAN registration, business registration certificate, and owner’s details.

3. Fill out the VAT registration form and provide necessary financial records.

4. Obtain the VAT certificate after verification.

How can I get a TIN number in Nepal?

1 Visit the nearest Inland Revenue Office (IRO) or apply online via IRD’s official portal.

2. Submit the required documents, including citizenship, business registration (if applicable), and passport-sized photos.

3. Fill out the PAN registration form (TIN and PAN are the same for individuals).

4. Receive the Taxpayer Identification Number (TIN) instantly after verification.

Where can I get the VAT number?

The VAT number is issued by the Inland Revenue Department (IRD) Nepal through its regional offices. Businesses can also obtain their VAT number online via the IRD e-Tax system after successfully completing the VAT registration process.

What is the difference between PAN and VAT in Nepal?

In Nepal, a Permanent Account Number (PAN) is mandatory for individuals and businesses to track tax payments and file returns. A Value Added Tax (VAT) Number, on the other hand, is required only for businesses that exceed an annual turnover of NRs. 2 million for goods or NRs. 1 million for services. While all VAT-registered businesses must have a PAN, not all PAN holders are required to register for VAT.

What is the full form of TIN?

TIN stands for Taxpayer Identification Number, which is assigned to individuals and businesses for tax compliance and tracking purposes.

How much tax is deducted from salary in Nepal?

In Nepal, a 1% Social Security Tax is deducted from all salaries. Income tax is applied progressively, with rates based on annual earnings. Salaries up to NRs. 500,000 are only subject to the 1% Social Security Tax. For incomes between NRs. 500,001 – 700,000, a 10% tax applies. Earnings between NRs. 700,001 – 1,000,000 are taxed at 20%, while those between NRs. 1,000,001 – 2,000,000 face a 30% tax rate. Incomes exceeding NRs. 2,000,000 are subject to 36% tax. Married taxpayers may benefit from additional tax deductions.

CORPORATE LAW FIRM IN DUBAI

Related posts:

- https://taxconsultantnepal.com/branch-office-registration-in-nepal-contact-liaison-office/

- https://lawaxion.com/non-resident-nepali-nrn-id-card-in-nepal/

- https://lawaxion.com/education-consultancy-license-process-in-nepal/

- https://companynp.com/travel-and-tours-company-registration-in-nepal/

- https://taxconsultantnepal.com/export-import-license-process-in-nepal/

- https://lawaxion.com/manpower-license-process-in-nepal/

- https://taxconsultantnepal.com/nrn-citizenship-process-in-nepal-2025-2/

- https://taxconsultantnepal.com/non-profit-organization-registration-process-in-nepal/

- https://companynp.com/trademark-registration-process-in-nepal/

- https://taxconsultantnepal.com/company-registration-process-in-nepal/

- https://lawaxion.com/foreign-direct-investment-approval-process-in-nepal/

- https://lawaxion.com/criteria-for-five-star-hotel-in-nepal/