This guide provides a lawyer’s insight into Branch Office Registration in Nepal, covering essential aspects to understand the process along with compliances. It shall provide effective insights such as applicable laws, regulatory requirements, step-by-step procedures, and post-registration compliances along with TCN’s services in registering Branch Offices in Nepal.

What is Branch Office Registration in Nepal?

Branch office registration in Nepal refers to the legal process of establishing a local presence for a foreign company within the country. This allows international businesses to operate in Nepal while maintaining their primary headquarters elsewhere. A branch office is not a separate legal entity but an extension of the parent company, operating under the same name and sharing the same legal identity.

Key points to understand about branch office registration in Nepal:

- It’s a way for foreign companies to conduct business activities in Nepal

- The branch office remains part of the parent company

- It allows for a physical presence in the Nepalese market

- Branch offices can engage in various business activities as permitted by law

- They are subject to Nepalese regulations and tax laws

- Registration is mandatory before commencing operations

TCN, with its team of 20+ professionals, including Chartered Accountants, Corporate Lawyers, and Advisors, assists foreign companies and businesses with Branch Office Registration in Nepal at competitive pricing, ensuring quick registration and professionalism. We support companies in registering their branch offices with all regulatory authorities and provide complete tax, accounting, and corporate compliance services in Nepal.

Which Authority Registers Branch Offices in Nepal?

In Nepal, the primary authority responsible for registering branch offices is the Company Registrar’s Office (OCR), which operates under the Ministry of Industry, Commerce, and Supplies. The OCR oversees the registration process and ensures compliance with relevant laws and regulations.

Other key authorities involved in the registration process include:

- Department of Industry (DOI)

- Nepal Rastra Bank (NRB) – for foreign investment approval

- Inland Revenue Department (IRD) – for tax registration

- Department of Immigration – for visa processing

The CRO acts as the central point of contact for branch office registration, coordinating with other government agencies as needed. Foreign companies must work closely with the CRO throughout the registration process to ensure all requirements are met and the necessary approvals are obtained.

What Laws Govern Branch Office Registration in Nepal?

Branch office registration in Nepal is governed by several laws and regulations that ensure proper oversight and compliance. The primary legal frameworks include:

- Companies Act, 2063 (2006)

- Foreign Investment and Technology Transfer Act, 2075 (2019)

- Industrial Enterprises Act, 2076 (2020)

- Income Tax Act, 2058 (2002)

- Foreign Exchange Regulation Act, 2019

These laws collectively establish the rules for foreign company operations, investment procedures, and taxation in Nepal. They define the rights and obligations of branch offices, ensuring that foreign businesses operate within the country’s legal framework.

Understanding these laws is crucial for foreign companies planning to establish a branch office in Nepal. It’s advisable to consult with legal experts familiar with Nepalese business laws to ensure full compliance and avoid potential legal issues.

How to Establish a Branch Office in Nepal?

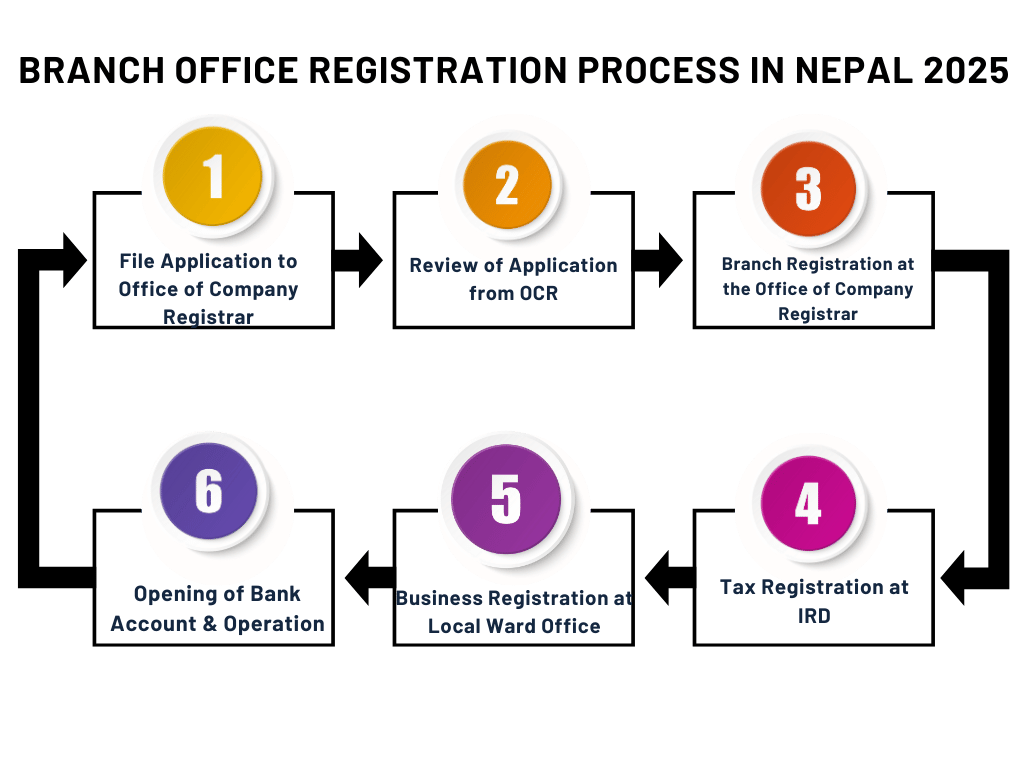

Branch Office Registration Process in Nepal

- Step 1: File Application to Office of Company Registrar

- Step 2: Review of Application from OCR

- Step 3: Branch Registration at OCR

- Step 4: Tax Registration at IRD

- Step 5: Business Registration at Local Ward Office

- Step 6: Opening of Bank Account and Operation

Registering a branch office in Nepal involves several steps and interactions with various government agencies.

Step 1: Obtain Approval from the Department of Industry

First, submit an application to the Department of Industry (DOI) for approval to establish a branch office. This application should include details about the parent company, proposed activities in Nepal, and investment plans.

Step 2: Apply for Registration with the Company Registrar’s Office

Once DOI approval is obtained, apply to register a company in nepal with the Company Registrar’s Office. Submit all required documents, including the parent company’s incorporation certificate, board resolution, and proposed branch office details.

Step 3: Obtain PAN and VAT Registration

After CRO registration, apply for a Permanent Account Number (PAN) and Value Added Tax (VAT) registration with the Inland Revenue Department. This is essential for tax compliance for office branch.

Step 4: Open a Bank Account

With the registration certificate and PAN, open a local bank account for the branch office. This account will be used for all financial transactions in Nepal.

Step 5: Apply for Necessary Permits and Licenses

Depending on your business activities, you may need additional permits or licenses from relevant authorities. Research and apply for these as required.

Step 6: Register with the Social Security Fund

If you plan to employ local staff, register with the Social Security Fund to ensure compliance with labor laws and social security requirements.

Step 7: Notify the Nepal Rastra Bank

Finally, notify the Nepal Rastra Bank about the establishment of your branch office, especially if you plan to bring in foreign investment or repatriate profits.

This process of Registering a Branch Office typically takes 15-25 Working Days in Nepal through the services provided by TCN based on the efficiency of response and document preparation.

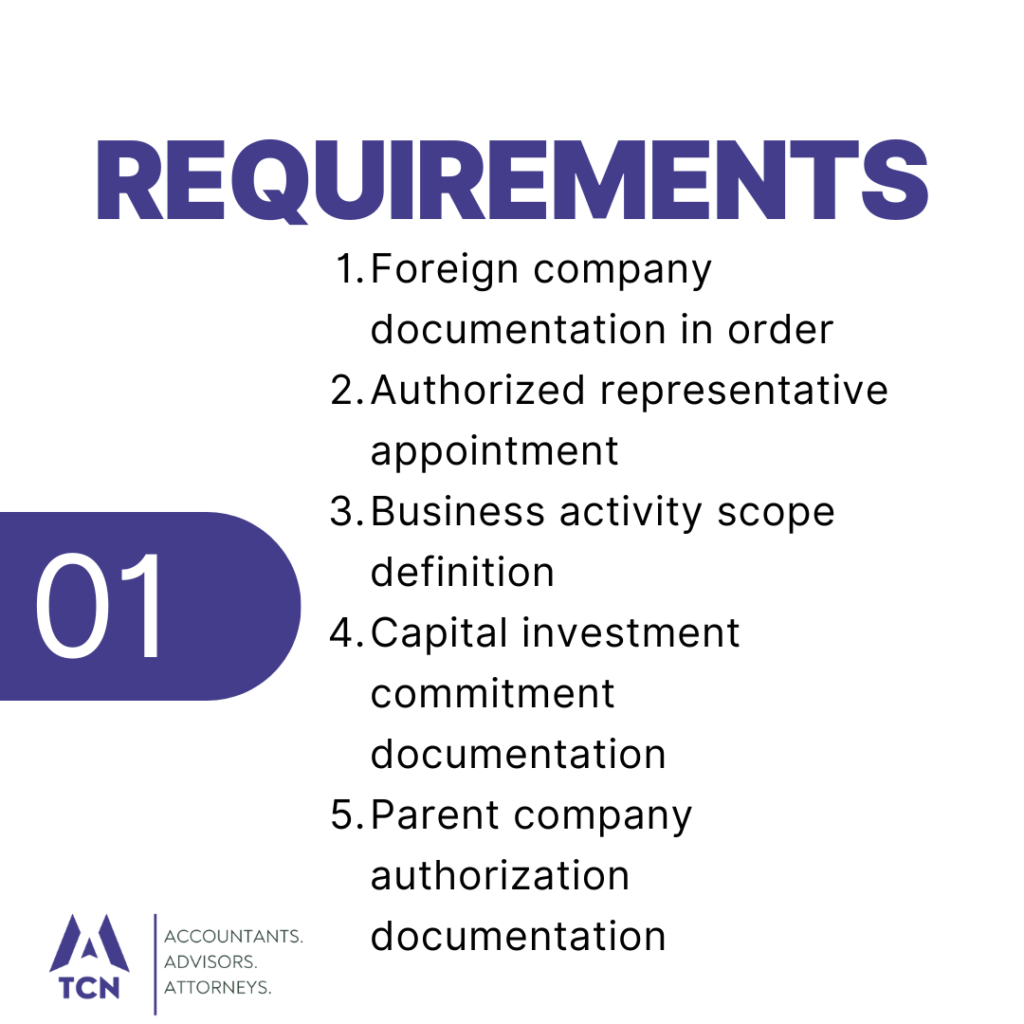

What Documents are Required for Branch Office Registration?

To successfully register a branch office in Nepal, you’ll need to prepare and submit various documents. Here’s a comprehensive list of the required paperwork:

- Application form for branch office registration

- Board resolution from the parent company authorizing branch office establishment

- Notarized copy of the parent company’s incorporation certificate

- Memorandum and Articles of Association of the parent company

- Latest audited financial statements of the parent company

- Power of Attorney for the branch office representative in Nepal

- Passport copies of parent company directors and the branch office representative

- Proposed organization structure of the branch office

- Business plan outlining activities to be conducted in Nepal

- Lease agreement or property ownership documents for the branch office premises

It’s important to note that all documents originating from outside Nepal must be notarized and authenticated by the Nepalese embassy in the country of origin. Additionally, documents in languages other than English or Nepali must be accompanied by certified translations.

Ensuring all required documents are properly prepared and submitted can significantly streamline the registration process and help avoid unnecessary delays or complications.

Distinction Between a Branch Office and the Registration of a Liaison Office

A branch office and a liaison office in Nepal serve different business purposes:

| Feature | Branch Office | Liaison Office |

|---|---|---|

| Legal Status | Part of the parent company | Part of the parent company |

| Business Activities | Can engage in commercial activities | Cannot engage in commercial activities |

| Revenue Generation | Allowed to generate revenue | Cannot generate revenue |

| Regulatory Approval | Requires approval from DOI & OCR | Requires approval from DOI |

| Tax Liability | Subject to corporate tax | Exempt from corporate tax |

A liaison office in Nepal is primarily established for network

How Long Does Branch Office Registration Take?

The duration of the branch office registration process in Nepal can vary depending on several factors. On average, it takes about 4-6 weeks to complete the entire registration process. However, this timeline can be influenced by:

- Completeness and accuracy of submitted documents

- Responsiveness of government agencies

- Complexity of the business activities

- Any additional permits or licenses required

- Public holidays or unforeseen administrative delays

To expedite the process:

- Ensure all documents are complete and accurate before submission

- Respond promptly to any requests for additional information

- Consider hiring a local consultant familiar with the registration process

- Plan for potential delays and start the process well in advance of your intended operation date

While the process may seem lengthy, it’s designed to ensure proper vetting and compliance with Nepalese laws. Patience and thorough preparation can help smooth the registration journey.

What are the Costs of Registering a Branch Office?

Registering a branch office in Nepal involves various costs that foreign companies should budget for. While exact amounts can vary, here’s an overview of the typical expenses:

- Registration fee at the Company Registrar’s Office: Approximately NPR 9,500

- PAN and VAT registration: Nominal fees (less than NPR 1,000)

- Legal and professional fees: Varies, but typically ranges from NPR 100,000 to NPR 300,000

- Document translation and notarization: Depends on the volume, roughly NPR 20,000 to NPR 50,000

- Bank account opening charges: Minimal, usually less than NPR 5,000

- Lease deposit for office space: Typically 2-3 months’ rent

- Initial working capital: As per company requirements (minimum NPR 5,000,000 recommended)

Additional costs may include:

- Sector-specific license fees

- Immigration fees for expatriate employees

- Social Security Fund registration fees

It’s important to note that these costs are subject to change and may vary based on the specific circumstances of each company. Always check with the relevant authorities or a local consultant for the most up-to-date information on registration costs.

What are Post-Registration Requirements for Branch Offices?

After successfully registering your branch office in Nepal, there are ongoing compliance requirements to maintain good standing with the authorities. These post-registration obligations include:

Annual Compliance

- File annual returns with the Company Registrar’s Office

- Submit audited financial statements

- Renew business licenses and permits as required

Tax Compliance

- File monthly VAT returns (if applicable)

- Submit quarterly and annual income tax returns

- Withhold and remit employee income tax

Labor Law Compliance

- Maintain proper employment records

- Contribute to the Social Security Fund for employees

- Adhere to local labor laws regarding working hours, leave, and benefits

Foreign Exchange Regulations

- Comply with Nepal Rastra Bank regulations on foreign currency transactions

- Obtain necessary approvals for repatriation of profits

Other Requirements

- Maintain proper books of accounts in Nepal

- Notify authorities of any changes in company structure or operations

- Renew visas and work permits for expatriate employees

Staying compliant with these post-registration requirements is crucial to avoid penalties and ensure smooth operations of your branch office in Nepal.

Who Can Open a Branch Office in Nepal?

Nepal welcomes foreign businesses to establish branch office what is criteria and restrictions to consider. The following entities are generally eligible to open a branch office in Nepal:

- Foreign companies legally incorporated in their home countries

- International non-governmental organizations (INGOs)

- Multinational corporations

- Foreign banks and financial institutions (subject to special regulations)

However, some restrictions apply:

- The parent company must have been in operation for at least three years

- Certain sectors may have limitations on foreign participation

- The proposed activities must align with Nepal’s foreign investment policies

It’s important to note that:

- Individuals cannot open branch offices; it must be a registered company

- The branch office activities should be an extension of the parent company’s core business

- Some sectors may require additional approvals or joint ventures with local partners

Before proceeding with registration, foreign companies should carefully review Nepal’s foreign investment policies and consult with local experts to ensure eligibility and compliance with all requirements.

What are the Benefits of Registering a Branch Office?

Registering a branch office in Nepal offers numerous advantages for foreign companies looking to expand their operations. Here are some key benefits:

- Market Entry: Provides a legal framework to enter and operate in the Nepalese market

- Brand Presence: Allows companies to establish a physical presence and build brand recognition

- Operational Flexibility: Enables direct control over operations and decision-making

- Local Hiring: Facilitates the recruitment of local talent and expertise

- Business Development: Supports closer relationships with local clients and partners

- Tax Benefits: May offer certain tax advantages compared to other business structures

- Repatriation of Profits: Allows for easier repatriation of profits to the parent company

Additional advantages include:

- Access to local resources and supply chains

- Ability to participate in government tenders and projects

- Easier coordination with local authorities and stakeholders

- Potential for long-term growth and expansion in Nepal and the region

By registering a branch office, foreign companies can effectively tap into Nepal’s growing economy while maintaining strong ties to their parent organization. This structure offers a balance of local presence and global strategy, making it an attractive option for many international businesses.

In conclusion, registering a branch office in Nepal can be a strategic move for foreign companies looking to expand their operations in South Asia. While the process involves several steps and requires careful attention to legal and regulatory requirements, the benefits of establishing a local presence can be significant.

How to Register a Branch Office in Nepal?

1. Obtain approval from the Department of Industry (DOI).

2. Submit required documents, including MOA, AOA, and parent company details.

3. Register with the Office of Company Registrar (OCR).

4. Acquire PAN and VAT registration.

5. Open a bank account in Nepal.

How to Register a Liaison Office in Nepal?

Registering a Liaison Office in Nepal requires approval from Nepal Rastra Bank (NRB). Submit documents like the parent company’s details, a no-objection certificate, and a project proposal. Register with the OCR, obtain PAN and VAT registration, and open a bank account. A Liaison Office acts as a communication channel and cannot engage in commercial activities or generate profits. It must comply with NRB and tax regulations.

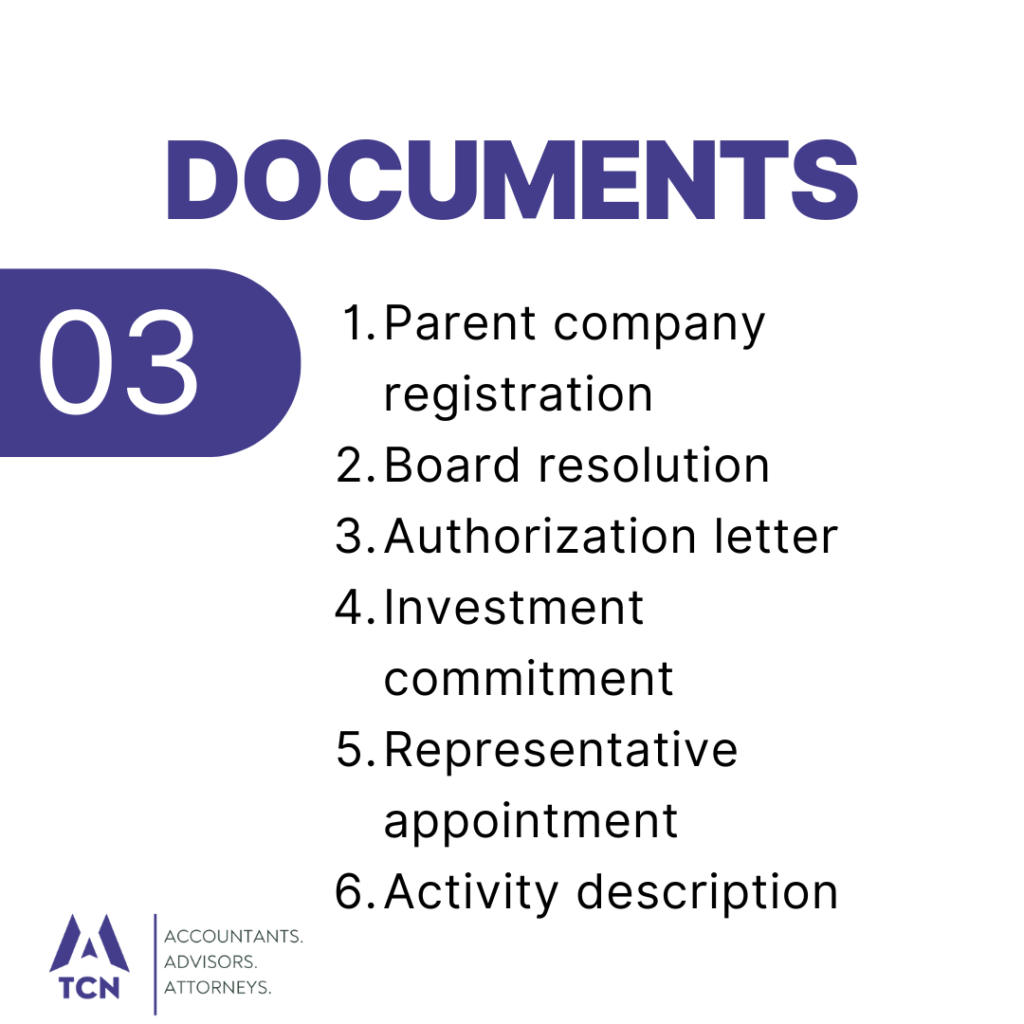

What documents are required for Branch Office Registration in Nepal?

The Documents Required for Registering a Branch Office are:

1. Memorandum of Association (MOA) of the parent company.

2. Articles of Association (AOA) of the parent company.

3. Board Resolution approving the establishment of the branch office.

4. Audited Financial Statements of the parent company for the last fiscal year.

5. No-Objection Certificate (NOC) from the parent company.

6. Approval from Nepal Rastra Bank (NRB) (if foreign investment is involved).

7. Passport-sized photos and identity proof of the authorized representative.

How to Register Foreign Office in Nepal?

To register a Foreign Office, obtain NRB approval for foreign investment. Submit the parent company’s documents, a project proposal, and register with the DOI and OCR. Acquire PAN and VAT registration, and open a local bank account. The office can represent the parent company but must adhere to Nepal’s legal and tax requirements.

What activities can Branch Office conduct?

A Branch Office in Nepal can engage in marketing, customer support, and product representation. However, it cannot independently undertake manufacturing or profit-generating activities. It operates under the parent company’s scope and must comply with local laws, including tax filings and annual returns.

What happens after Foreign Branch Registration in Nepal?

After registration, the branch office can legally operate, hire staff, and conduct approved activities. It must comply with Nepalese tax laws, file annual returns, and renew permits as required.

What is the Difference between Branch and Liaison Office?

A Branch Office can engage in commercial activities like marketing and representation, while a Liaison Office serves as a communication channel between the parent company and Nepalese entities. Unlike a Branch Office, a Liaison Office cannot conduct direct business or earn profits. Both must comply with Nepal’s legal and tax regulations.